Introduction

It goes without saying that COVID-19 and the pandemic has been and is a terrible thing, and today I am going to go over Alpha Pro Tech. People have gotten terribly sick and many have even succumbed to this horrible virus. Clearly, there is nothing good or positive that can be said about this scourge from a purely human or humanity perspective.

On the other hand, from a pure investment perspective, the pandemic has brought significant growth to certain industries. Obviously, the vaccine industry stands to profit handsomely as many companies roll out vaccines to protect people. Furthermore, an article in the Wall Street Journal over the weekend posits that COVID-19 is likely here to stay. The title of the article says it all: “As Covid-19 Vaccines Raise Hope, Cold Reality Dawns That Illness Is Likely Here to Stay.” The article’s byline also provides insight into the investment opportunities that this scourge might bring: “Ease of transmission, new strains, limits of vaccination programs all mean COVID-19 will be around for years—and a big business.” Here is a link to the complete article which is available for those who subscribe to the Wall Street Journal.

For those of you who are not Wall Street Journal subscribers, the following excerpt from the above article summarizes the opportunity for certain industries:

“But some organizations are planning for a long-term future in which prevention methods such as masking, good ventilation and testing continue in some form. Meanwhile, a new and potentially lucrative Covid-19 industry is emerging quickly, as businesses invest in goods and services such as air-quality monitoring, filters, diagnostic kits and new treatments.”

Alpha Pro Tech Limited: (APT)

Alpha Pro Tech Limited is one company that stands to prosper because of the pandemic. The following company summary courtesy of Zacks Investment Research describes the opportunity:

“Alpha Pro Tech is in the business of protecting people, products and environments. The Company develops, manufactures, and markets disposable protective apparel and infection control products through its subsidiary, Alpha Pro Tech, Inc. Its products find their application in the clean room, industrial, pharmaceutical, medical, and dental markets. Products offered by Alpha include: shoecovers, bouffant caps, gowns, coveralls, lab coats, face masks, eye shields, and medical bed pads, and etc. Alpha Pro Tech is based in Markham, Canada.”

The following screenshot taken directly from the company’s website showcases some of the long-term business opportunities that Alpha Pro Tech has with face shields and masks alone:

Alpha Pro Tech Limited: By The Numbers

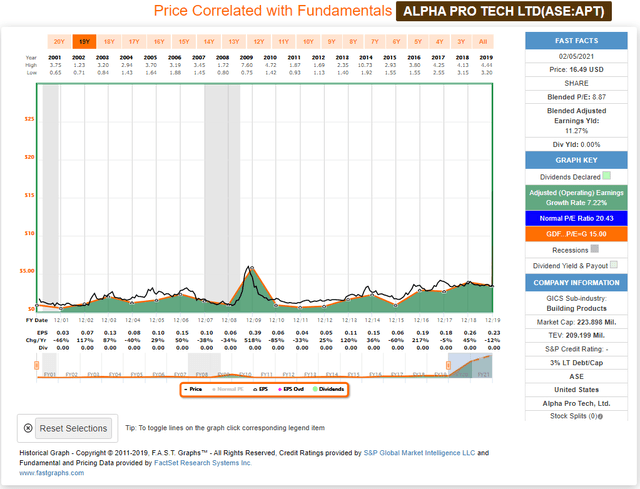

As you can see by the following FAST Graphs earnings and price correlated graphic from fiscal year 2001 through fiscal year 2019, Alpha Pro Tech was a stable but only a moderately fast grower. Over this timeframe earnings grew by 7.22% per annum. But most notably, prior to COVID-19the company’s historical stock price has clearly tracked and correlated to the company’s operating results almost perfectly. The company pays no dividend and only has 3% long-term debt to capital on its balance sheet.

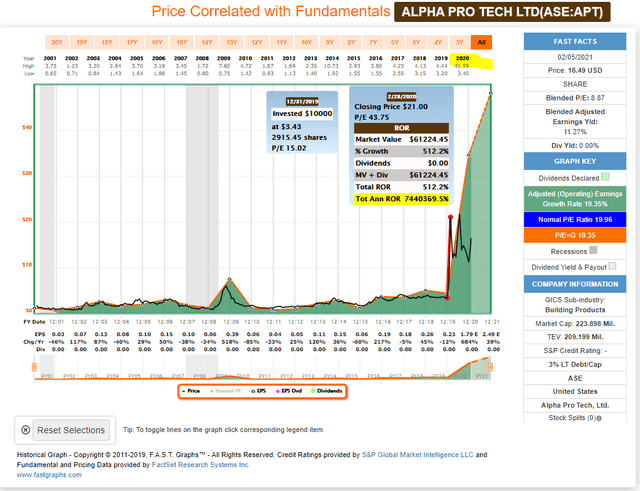

With this next graphic we see clear evidence of the power and investment opportunity of operating results. For this company, the pandemic brought a 684% surge in earnings growth for 2020 over 2019. And with that surge in earnings growth came a subsequent surge in market price from $3.43 on December 31, 2019 to a closing price of $21 by February 28, 2020. Note, that $21 was the monthly closing price on February 28, but the monthly high price for 2020 was $41.59.

This simply illustrates that had you bought the stock on December 31, 2019 and were fortunate (LUCKY) enough to sell it at its peak value for 2020, you would have made over 12 times your money in less than a year’s time (see High Low price highlighted yellow at top of the graph). Of course, few people likely had timing which was that perfect or impeccable. Nevertheless, it illustrates the magnitude of the opportunity that that surge in earnings growth provided.

The Opportunity Is Not Lost

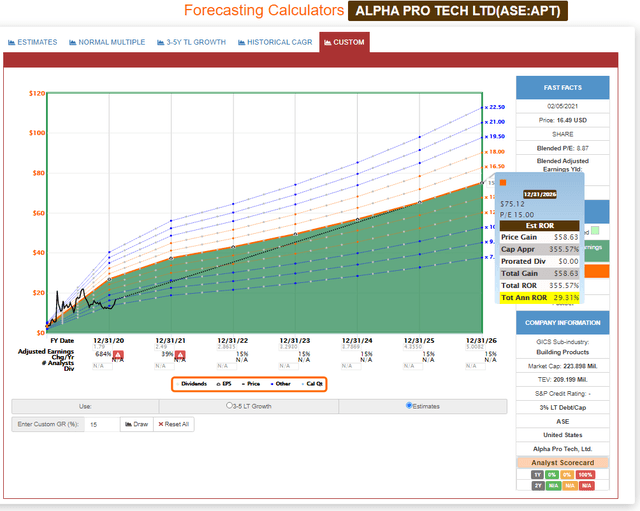

The opportunity to invest in Alpha Pro Tech is not lost. Since the February 28, 2020 closing price of $21 per share, Alpha Pro Tech’s stock price closed yesterday 21.5% lower at $16.49. The blended P/E ratio is at a very attractive 8.87 times earnings, offering an earnings yield of 11.27%. These are just the kinds of metrics that yours truly A.K.A., Mr. Valuation loves to see. Stated succinctly, Alpha Pro Tech offers an opportunity to invest in high growth at a reasonable (attractive) price.

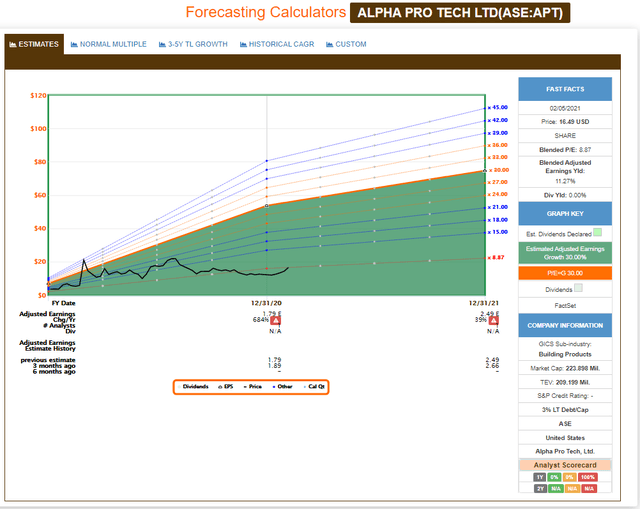

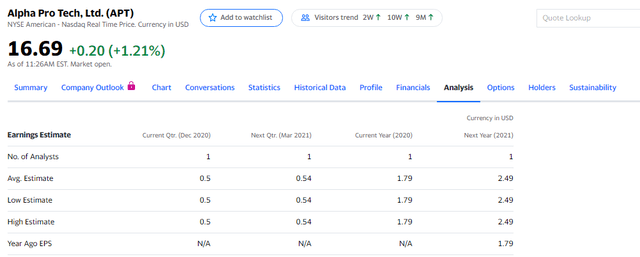

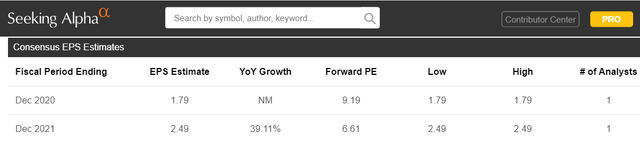

Consensus Specific Near-Term Earnings Estimates

The reader should be forewarned that there is an element of speculation associated with the stock. Since Alpha Pro Tech is a small-cap with a market value of only $223.898 million, it is not widely followed on Wall Street. FAST Graphs (courtesy FactSet), Yahoo Finance (courtesy Refinitiv) and Seeking Alpha (courtesy Standard & Poor’s) only lists one analyst offering an earnings estimate for 2020 of $1.79 (note: 2020 earnings release date is estimated at February 26, 2021) and $2.49 for fiscal 2021.

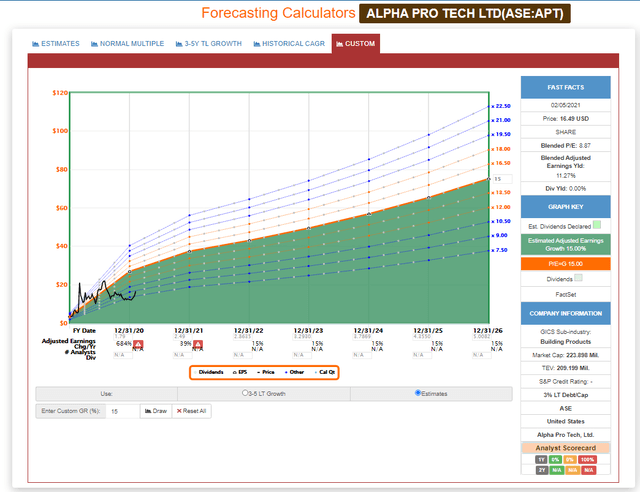

The following FAST Graphs forecasting calculator illustrates the opportunity that today’s low valuation offers relative to expected growth. In this case the orange line would represent fair value based on Peter Lynch’s famed formula P/E ratio equal to earnings growth rate.

Yahoo Finance forecasts the exact same earnings numbers as seen above.

The same is true from the forecasts provided by Seeking Alpha courtesy of Standard & Poor’s:

Consensus Long-Term Growth Estimate

In addition to specific near-term estimates, analysts typically also provide a long-term (typically 3 to 5 year) trendline estimate. Although the long-term trendline estimate may in fact be slightly less accurate over the near term than specific estimates, they are very useful for assessing long-term potential. Furthermore, we would be naïve to believe that our earnings or cash flow estimates could be made with perfect precision. They cannot. However, it is also important to apply common sense and recognize that getting the direction of the company’s operating results is of equal importance as a specific number.

In other words, first ask yourself if this company or investment has the potential to grow positively in the future, and then attempt to access how much growth you think is available. Ultimately, the bottom line suggests that the magnitude of the future cash flows the business generates on your behalf will determine how much money you make or lose on that investment. But with that said, if the company grows, then your money will likely grow with it. Conversely, if the business does not grow, then your money will likely not grow as well. Try to be as accurate as possible with your forecasts, but simply recognize that perfect precision is simply not possible. Consider that the only thing certain about the future is uncertainty.

Long-term Forecasts Display Incredible Opportunity

If Alpha Pro Tech grows even at only 15%, which is half as fast as next year’s forecast, long-term opportunity to profit is extremely well defined. If you believe that COVID is around for the long haul, then you should also believe that Alpha Pro Tech is well positioned to participate in that growth going forward. However, you should always consider the downside as well. This is a small company, and there are competitors such as 3M with much larger resources that are also competing in the space. Nevertheless, this company is established, possesses the expertise and experience, and therefore are likely to hold their own.

FAST Graphs Analyze Out Loud Video: Alpha Pro Tech Limited, A Growth Opportunity

In the following video I elaborate more on the opportunity that this COVID-19 pandemic growth stock play offers for those interested in total return. Clearly it is not a dividend paying stock. Nevertheless, I found it was extremely important to illustrate that the market does provide opportunities to invest in high growth at reasonable values from time to time. This is typically referred to as a GARP – or growth at a reasonable price – opportunity. With growth stocks I am willing to pay more than the typical P/E ratio of 15. When evaluating growth stocks, I tend to rely on Peter Lynch’s famed formula P/E ratio equal to earnings growth rate.

Summary and Conclusions

I found it both interesting and fascinating to analyze and evaluate Alpha Pro Tech as a GARP (growth at a reasonable price) investment opportunity. It has always been a decent company, which is illustrated above, produced a consistent slightly above-average growth over the long run. Furthermore, the company was established in 1989 initially as a fascial company but grew through acquisitions that added facemask, disposable protective garments, automated shoe covers, and lamination capabilities.

Therefore, I offer this currently fast growing small-cap as a great opportunity for investors seeking a high total return to research and examine more closely. From what I have seen with my initial review, this could be a very profitable business and therefore investment opportunity over the next several years. Caveat emptor – let the buyer beware.

Disclosure: No position.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Try FAST Graphs for FREE Today!