Introduction

We remain in one of the longest bull markets in history. Generally, with bull markets stocks tend to become highly valued. Additionally, we also continue to find ourselves in a low interest rate environment based on historical standards. However, after bottoming out in January 2017, interest rates have steadily increased. Although interest rates remain low based on historical norms, the fear of rates rising in the future has begun to unsettle the stock market.

So far, October 2018 has brought us dropping stock prices. Consequently, there has been the beginnings at least of a correction in the valuations of many high-quality dividend growth stocks. This is important, because for the most part, high-quality dividend growth stocks had become quite expensive. Although the correction has been broad-based, there are certain sectors such as the financial sector and the healthcare sector that have been hardest hit.

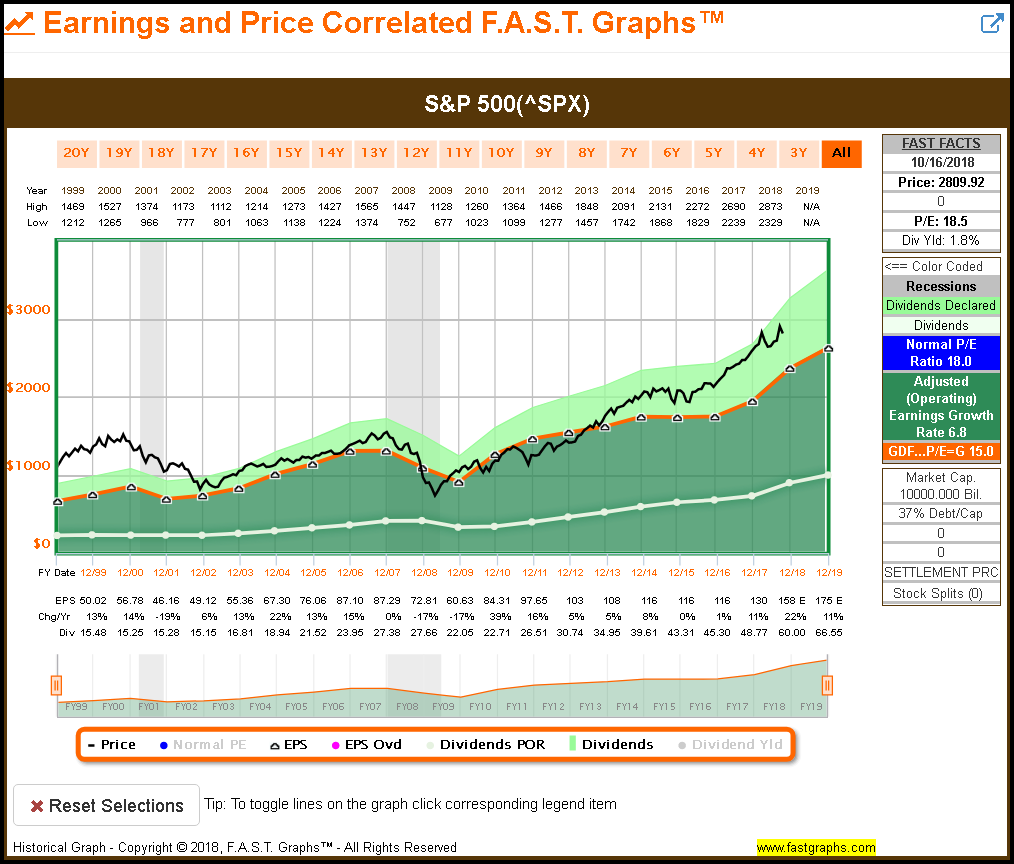

Furthermore, although stock prices have generally been falling recently, I think we are far from calling it a true correction and certainly far from calling it a bear market. The following earnings and price correlated FAST Graph on the S&P 500 puts the recent weakness into a clear perspective.

The S&P 500 Current Valuation Based On Past Results

The following earnings and price correlated FAST Graph on the S&P 500 since calendar year 1999 illustrates the overvaluation that has become manifest since the Fall of 2013. Moreover, we see that the dropping stock prices experienced this month had not made a material difference in valuation. Obviously, every little bit helps, but the S&P 500’s valuation remains high based on historical norms and a longer term earnings growth rate of 6.8%.

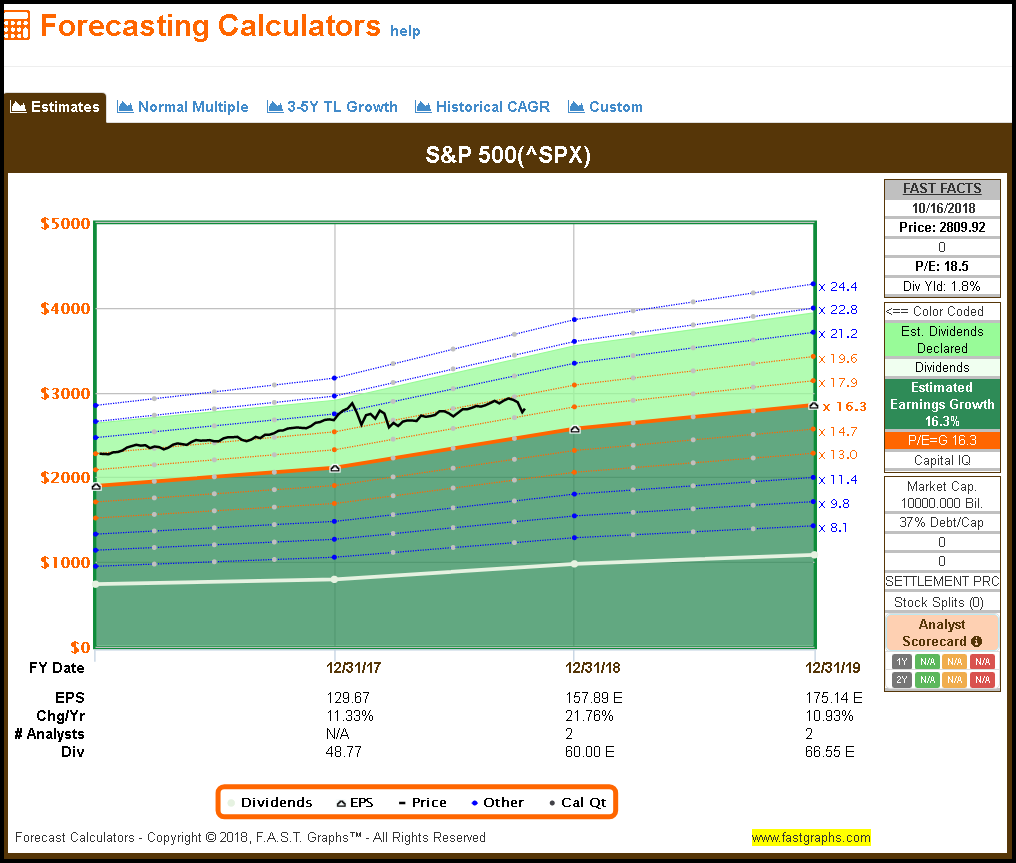

The S&P 500 Valuation Based on Forecasts

From a historical perspective seen above, the S&P 500 is clearly overvalued. On the other hand, from a future perspective, it can be argued that the S&P 500 is simply fully valued but within the valuation corridor depicted by the light orange lines on the forecasting calculator below. The primary differentiator is a forecast for future growth of 16% versus the historical growth of 6.8% we saw on the long-term historical graph.

Stock prices have dropped, but in my opinion and as illustrated in the above graphics, the general drop in stock prices has been benign relative to the reaction of many investors. Stated differently, valuations for the general market have not really changed much at all. On the other hand, as previously stated, there are certain sectors that have been hit much harder. However, I do contend that most high-quality blue-chip dividend growth stocks remain excessively valued.

This presents a conundrum of sorts to the dividend growth investor that would like to create a long-term dividend growth portfolio in today’s market. Although it is harder to accomplish in a strong bull market like we have today, it can be done. It has long been my contention that attractive valuations can be found in all market environments. Clearly, there is more value to be found in a bear market and less value to be found in a strong bull market like we have today. Consequently, it is harder to find attractive dividend growth stocks in today’s bull market, but not impossible. Nevertheless, as I will illustrate later, it is a market of stocks and not a stock market.

There’s More Than One Way to Skin A Cat

In my most recent article I covered Whirlpool Corporation which I considered a fair company at a wonderful price. As a result, I was called to task by several readers citing the popular Warren Buffett quote: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Frankly, under normal stock market valuation scenarios, Warren’s quote represents my preferred method of building a stock portfolio. However, in today’s bull market it has simply been difficult to identify enough high-quality companies available at fair prices with which to build a portfolio upon.

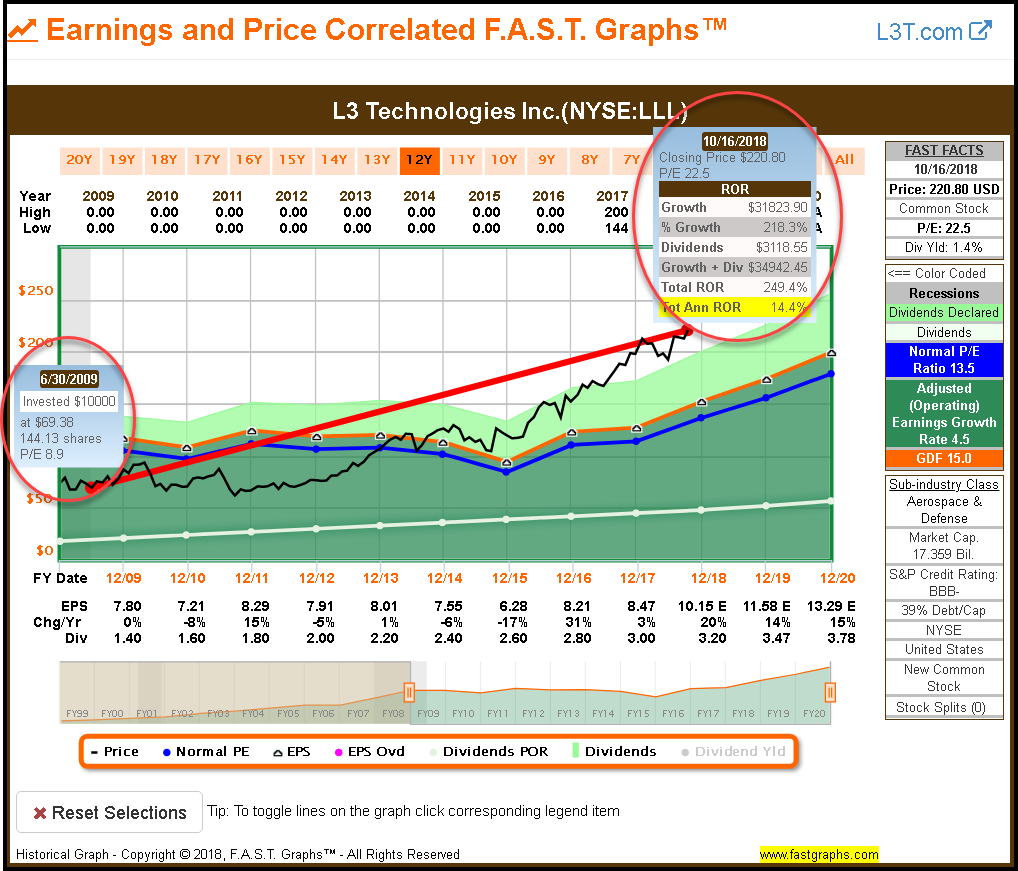

Personally, I have been dealing with this frustration for some time. Nevertheless, even though it may technically be better (safer) to buy a wonderful company at a fair price, this doesn’t mean that investing in a fair company at a wonderful price is a bad idea. For example, in 2009 I wrote an article on L3 Technologies Inc., that I considered a fair company (BBB-S&P credit rating) but at a wonderful price represented by a P/E ratio of only 8.9.

Had an investor invested in L3 Technologies on June 30, 2009 and held it until yesterday’s close, the total annualized rate of return would have been 14.4%. That is a rate of return that I would take every day of the week. However, if you notice on the following graphic, earnings-per-share growth from 2009 through 2015 was negative, further indicating L3 Technologies as only being a fair company. Nevertheless, it proved to be an excellent investment. In short, there are exceptions to every rule.

15 High-Quality A- Rated (or Better) Fairly Valued Dividend Growth Stocks

Even though I consider the market correction cited above more benign than many people, it was enough to bring several high-quality dividend growth stocks into attractive valuation levels. More to the point, the correction was enough to produce 15 high-quality attractively valued dividend growth stocks that can be utilized as the foundation for building a dividend growth portfolio from scratch. To be clear, I consider each of the following research candidates wonderful companies available at fair or attractive prices (valuations).

To be included on this list, my selection criteria and process was simple and straightforward. Each company had to be rated A- or better by S&P. Additionally, each company had to pay a dividend that has grown at above-average rates. But most importantly, each company had to have produced a consistent above-average historical earnings growth rate and the expectations for continued growth going forward. Simply stated, I was looking for high quality dividend growth stocks (wonderful businesses) available at attractive valuations with the opportunity to generate above-average long-term total returns.

The following portfolio review presents my 15 wonderful businesses at fair prices in alphabetical order: AbbVie (ABBV), AmerisourceBergen (ABC), Ameriprise Financial (AMP), BlackRock (BLK), Comcast (CMCS.A), Intel (INTC), Illinois Tool Works (ITW), JP Morgan Chase (JPM), Altria (MO), PepsiCo (PEP), Principal Financial (PFG), Prudential Financial (PRU), Simon Property Group (SPG), State Street Corp (STT), U.S. Bancorp (USB):

FAST Graphs Analyze Out Loud Video: 15 Wonderful Dividend Growth Stocks at Fair Prices

In the following analyze out loud video I will elaborate on the attractive valuation I see in each of the 15 wonderful dividend growth stocks. However, an important caveat that relates to value investing is in order. The venerable Warren Buffett offered a profound quote that supports what I am about to offer. Warren suggested that, “you can’t buy what’s popular and expect to do well.” To this profound quote I would like to add the extension – over the longer run. Popular stocks can perform well in the short run, but the day of valuation reckoning inevitably manifests over the long run.

The primary implication and importance of Warren’s message speaks directly to value investing as a long-term strategy. Over short periods of time, stock prices can and often will behave quite irrationally. However, over the long run the value of the business shines through. Consequently, successful value investing requires holding your stocks long enough for the business results purchased at sound valuation to reward you.

Summary and Conclusions

In closing, value investing requires the implementation of a long-term strategy. Out-of-favor stocks can stay out-of-favor, and as a result continue dropping even if you purchase them at attractive values. However, as Warren Buffett also taught, “Price is what you pay, value is what you get.” Therefore, competent and intelligent value investors are prepared to suffer short-term price weakness. They can do this with the confidence that inevitably stock prices will move into alignment with intrinsic value.

With that said, I believe the 15 stocks featured in this article represent excellent long-term opportunities. They are all high-quality companies which are expected to continue growing in the future as they have in the past. However, for various reasons they are also out-of-favor. But never forget, that bargains are rarely found in the most popular stocks. The key is to recognize the fundamental value and buy them when no one else wants them. Do this, and solid returns at lower-than-typical levels of risk are sure to follow.

Disclosure: Long ABBV,ABC,AMP,INTC,PEP,PFG,STT

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.