Introduction

China has rapidly become the second largest economy in the world – second only to the United States, and by some calculations the largest. As a result, China also has some of the fastest-growing publicly traded companies on the planet. Moreover, tariff negotiations between the United States and China have recently become a political football that has resulted in a softening of prices on several prominent China domiciled American depository receipts (ADRs). With this article, I will be covering 7 prominent China-based ADRs listed on either the New York Stock Exchange or the NasdaqGS Exchange.

Some of these companies have experienced significant stock price corrections so far this calendar year, and others have corrected more modestly. However, in recent days most of these companies have become rather hot commodities. Therefore, the question I’m going to attempt to answer is whether these stocks have become attractive after the dip, but unattractive after the recent rallies. Nevertheless, my true motivation behind producing this article is to also offer an important lesson on value investing that is often overlooked by many investors when dealing with volatile stock prices.

The Geometry of Winning and Losing

There is a geometric phenomenon that occurs during volatile stock price action. Instead of thinking in arithmetic terms, investors are best served by understanding the geometry of stock price action. A few simple examples will illustrate the important lesson that I am attempting to highlight. If you invested $1 and your investment fell by 25% you would now have an investment worth $0.75. At this point it’s important to note that this $0.75 now represents the money that you have available for investment. More importantly, you must also recognize that your future returns must be calculated on that $0.75 and not your original investment of $1.

As a result, for you to recover your loss and grow your $0.75 back to $1, you must earn a return of 33%. This geometric phenomenon becomes more dramatic the greater your percentage loss. To simplify for clarity, if you invested $1 and lost 50% of your investment, you would now only have $0.50 available to invest. To grow that $0.50 back to $1, you would have to earn 100% return on your $0.50. This geometric exposure to loss explains why Warren Buffett has been quoted as stating that the number 1 rule in investing is “never lose money.” Or as my own personal mentor often preached – “to win you must not lose.”

In my previous article titled “Are Fang Investors Playing the Role of Greater Fool’s?” – I addressed the power of compounding by presenting and discussing the Rule of 72. Compounding future growth is also a geometric concept, and the 7 China-based stocks I am covering in this video are expected to grow at very high rates. However, the power of compounding also works in reverse as I illustrated above. The point is simple and straightforward; at the end of the day investing is all about understanding and correctly dealing with the dynamics of the numbers. In other words, it’s equally as important to understand the geometric phenomenon of loss as it is to understand the power of compounding at high rates of growth.

As this discussion relates to the 7 China-based stocks I am covering in this article, my point is that although they have been moving rather briskly to the upside recently, it has not changed the longer-term return opportunity I believe they offer. However, it is also important to understand that these high rate of return opportunities also come with higher risk. When analyzing and/or considering investing in growth stocks, the investor must also be cognizant of how difficult it is for companies to grow at the high rate you’re going to see with these 7 China-based companies. As previously stated, and as I will point out in the following analyze out loud video, these 7 companies trade at higher multiples of earnings, cash flows and other metrics than average growing companies do. But most importantly, to support those high valuations, they must continue to deliver high rates of growth.

Portfolio Review: 7 China-based ADRs

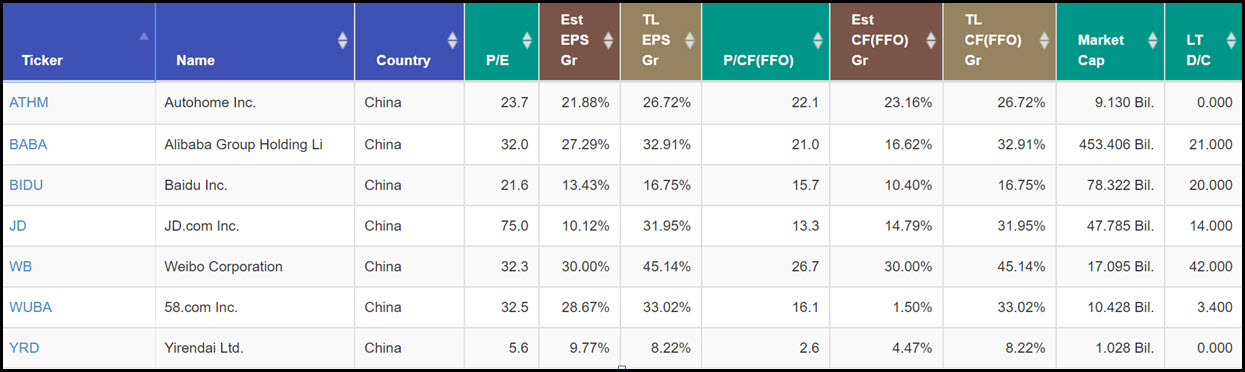

I have placed the 7 China-based companies I am covering in this article into a portfolio which I’ve customized to include the following: the ticker, name, country, P/E ratio, estimated earnings growth, long-term trend line earnings growth, price to cash flow, estimated cash flow growth, long-term trend line cash flow growth, market cap and debt to capital.

The areas I suggest the reader focus on are the current valuations based on blended P/E ratios or price to cash flow (P/CF) in relation to estimated growth rates of earnings per share (EPS) and/or estimated growth rates of cash flow (CF). As you evaluate these valuations and growth rates, try to keep the power of compounding (the Rule of 72) in the back of your mind to obtain a clear perspective of potential future returns these companies offer.

FAST Graphs Analyze Out Loud Video on 7 China Domiciled Growth Stocks

The following video will clearly illustrate the attractive valuations and long-term growth potential that each of these China-based companies currently offer. Moreover, I do think it’s important to recognize that since they are all ADRs, investors can have confidence that their financial results are consistent with US accounting standards and rules.

Summary and Conclusions

Investing in high-growth stocks is not for everyone, and certainly not for the faint of heart. In my opinion the biggest risk associated with investing in growth stocks is the likelihood that their growth will eventually slow down. If and/or when this happens, valuations will undoubtedly reset as well. Although it’s virtually impossible to forecast the precise moment that happens, the inevitability of this occurrence should not be overlooked. Nevertheless, if you’re looking for the opportunity to make high rates of return and willing to take on the associated risk, these 7 China-based companies might be worthy of the time and effort of conducting a more comprehensive research and due diligence process.

Disclosure: No Positions.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.