The question posed by the title of this article is whether or not 2011 will be the third year in a row of double-digit returns for the S&P 500. In calendar year 2009 the S&P 500 returned 26.4% and followed this up in 2010 by earning 15.06%. As we look forward to 2011 we see a distinct probability based on current consensus earnings estimates that the S&P 500 could increase an additional 11% – 13% this year. This would mark the third year in a row that the S&P 500 generated double-digit returns.

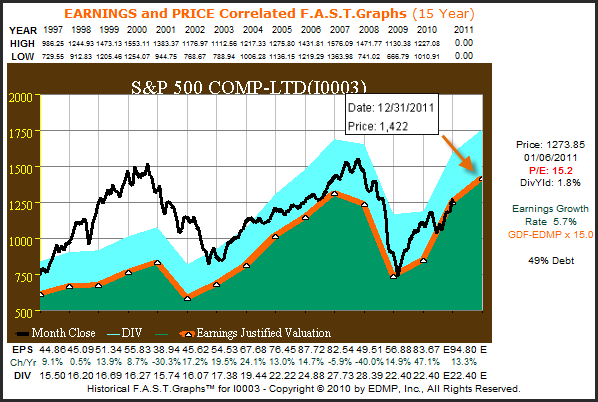

The following F.A.S.T. Graphs™ on the S&P 500 provides the current bottoms up operating earnings estimate of $94.80 from Standard & Poor’s Corporations website. If you multiply the $94.80 earnings estimate by an 80 year historical PE ratio of 15 for the S&P 500 you get an implied value of 1422. This is approximately 11% – 12% higher than the current value based on the 1273.85 level of the S&P 500 on January 6, 2011. Importantly, this is offered as a forecast of intrinsic value based on the S&P 500 reaching these earnings targets and being capitalized at a historic normal PE ratio.

Benjamin Graham on the past and future of common stocks

Courtesy of ValueHunter we were given the privilege and opportunity of reviewing a compilation titled Common Stock Investing: the papers of Benjamin Graham written by Benjamin Graham. As most readers probably know Mr. Graham is considered the father of modern security analysis. Furthermore, he has served as the mentor to some of the most famous and renowned disciples of value investing to include Jean-Marie Eveillard, Warren Buffett, William J. Ruane, Irving Kahn, Hani M. Anklis and Walter J. Schloss, to name just a few. One of Mr. Graham’s most famous, and we feel priceless, tidbits of wisdom is his often quoted:” the market is a voting machine in the short run and a weighing machine in the long run” metaphor.

In his compilation of papers mentioned above, Ben Graham provided similar insights about the stock market that we had not come across before but wanted to share. In one paper he talked about the past and future of common stocks as follows:

Before I came down to Wall Street in 1914 the future of the stock market had already been forecast-once and for all-in the famous dictum of J.P. Morgan the elder: it will fluctuate. It is a safe prediction for me to make that, in future years as in the past, common stocks will advance too far and decline too far, and that investors, like speculators-and institutions, like individuals-will have their periods of enchantment and disenchantment with equities.

The point of the above quote is simple, thanks to often irrational investor behavior by individuals and institutions alike, the stock market and stock prices can and will be mispriced from time to time. But Mr. Graham taught those of us wise enough to listen that inevitably stock prices would move to sound valuation based on fundamentals. Therefore, wise investors would recognize misappraisal (over or under), when it occurred and make rational long-term investment decisions accordingly.

Although the actual determination of intrinsic value is part art and part science, and therefore, cannot prudently be expected to be calculated with absolute precision, determinants of intrinsic value can be made with enough precision to be valuable.

In the past we’ve written about how any investment inevitably receives its value from the amount of cash flow it is capable of generating for its stakeholders. Regarding applying a fair value to those cash flows, we have previously discussed how even a no growth income stream, like those produced from fixed income securities such as a bond, would always have a value greater than one times its income stream. We used this logic to illustrate the validity behind the historical 15 PE ratio that has traditionally been awarded to the S&P 500, or common stocks in general. In the same papers mentioned above, Mr. Graham provided the following insight: “It seems logical to me that the earnings/price ratio of stocks generally should bear a relationship to bond interest rates.”

Conclusions

From the F.A.S.T. Graphs™ of the S&P 500 above, several observations are made clear. Most important of all, is the long-term correlation between earnings and stock price. In other words, prices will tend to move with earnings, and whenever they get disconnected from each other they will converge or revert to the mean. The 14-plus years covered in the above graph provide strong evidence of the validity of the 15 PE ratio. This is even more relevant when you consider the anomalous period of overvaluation described by the infamous label “irrational exuberance.” Since 1997 the S&P 500 has not fallen below this 15 PE level except for very brief points of time. Therefore, we suggest that a fair value calculation of future S&P 500 earnings is reasonable at a PE of 15.

Much will continue to be written about what’s going on with the economy: interest rates, employment levels, debt levels, inflation and on and on. Yet it becomes very clear that at the end of the day that it all comes down to earnings. The last two years of strong performance in the S&P 500 was almost completely overshadowed by dire forecasts of pending doom and gloom. Consequently, few investors were able to enjoy the prosperity that has followed the great recession. The adage that “Wall Street climbs a wall of worry” could be modified to Wall Street clawed and scratched its way up a head wall of extreme pessimism.

We intend to update the S&P 500 F.A.S.T. Graphs™ and earnings estimates each quarter. To repeat our position, we believe that earnings drive market price in the long run. Therefore, whatever level of earnings the S&P 500 ends up generating by year-end 2011 should be a major determining factor of what level this important index ends the year at.

In February of 2010 we presented the following article:

“S&P 500: A 20% rise in 2010?” dated February 21, 2010. You may find it interesting to revisit this article in order to see how relevant it was. The main difference was that we utilized the 20-year historical S&P 500 PE of 17.5 instead of the 80-year historical S&P 500 PE ratio of 15. This higher PE ratio was skewed because of the irrational exuberance that we previously mentioned. You will also notice that the current S&P 500 earnings per share for 2010 are higher than estimated in our February article.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.