Introduction-Investing in Alpha Pro Tech

For investors interested in investing in Alpha Pro Tech, on February 9, 2021 I produced the article titled “Alpha Pro Tech Well-Positioned To Participate In COVID-Led Growth.” In that original article I pointed out that Alpha Pro Tech (APT) was well-positioned to participate via earnings growth because of selling masks and other protective gear relevant to the COVID pandemic. I also provided earnings estimates courtesy of FactSet and corroborated by Reuters on Yahoo Finance and by Standard & Poor’s courtesy of Seeking Alpha. To date, those earnings estimates have not changed. Unfortunately, the same cannot be said about the stock price.

Anyone who has followed my work for a long time knows that I trust earnings (fundamentals) more than I do price volatility. Nevertheless, although not alone in that position, I believe we are certainly in the minority. The stock has dropped from $16.49 per share when I wrote the article, and as I write this is down to $11.41 for an additional 8.24% drop today. Which means the stock has essentially fallen about 30% since I wrote the original article.

Now, a 50% plus drop is certainly concerning, it becomes less concerning when you consider the fundamentals in the valuation that they represent. Additionally, when you consider the short time period that this has happened over, this is hardly a long-term mistake. It may turn out to be, and time will tell. However, I am not a day trader and I do not forecast short-term stock price movements, and as I have written many times, I do not trust stock price movements, I trust fundamentals. The fundamentals of this company have not deteriorated, in fact, they have gotten slightly better than they were when I first wrote the article. The fact that people are currently selling the stock means nothing if in the long-term scheme of things, the earnings come in as expected over the next two years.

In other words, the long-term upside to this investment remains the same. If that turns out to be true, then the smart thing would be to double down on this investment once the bleeding stops. I am confident that is going to happen because this was a solid business prior to COVID, and will likely be a solid business post COVID. On the other hand, I am not confident that this business will keep growing at these recent extraordinary rates once COVID is over. Nevertheless, I also shared excerpts from a Wall Street Journal article that suggested that “Covid 19 will be around for years – and a big business.” Here is the excerpt from that article that I shared:

“But some organizations are planning for a long-term future in which prevention methods such as masking, good ventilation and testing continue in some form. Meanwhile, a new and potentially lucrative Covid-19 industry is emerging quickly, as businesses invest in goods and services such as air-quality monitoring, filters, diagnostic kits and new treatments.”

The reason I bring this up is because the short-term stress that the stock price is going through appears to be based on the idea that many states are lifting the mask mandate. However, even where the mandate has been lifted, people were still wearing masks. Moreover, I believe people will continue wearing masks for some time into the future regardless of whether it is mandatory or not.

What is really interesting is that Alpha Pro Tech is tentatively scheduled to report earnings on March 9. I believe that will be an important happening to the fate of this company. I would expect they will come close to meeting current estimates of $1.79 a share for fiscal 2020. The real question will be if guidance and/or estimates for 2021 – which currently sit at $2.49 – materially change or not.

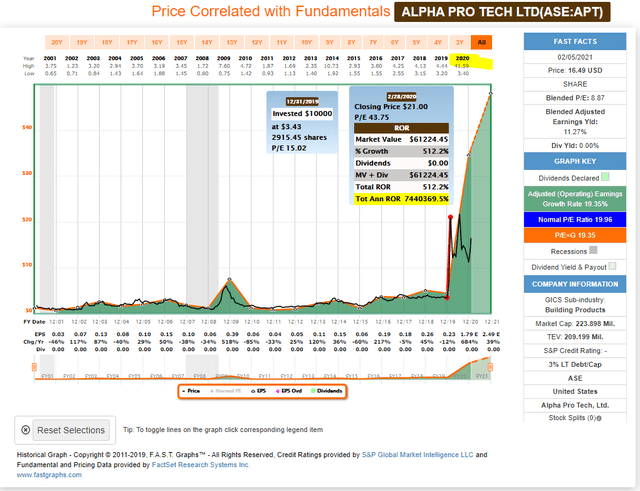

Alpha Pro Tech February 5, 2021

Here is what Alpha Pro Tech looked like when I published the article on February 5. Note the surge in earnings growth but further note the extreme volatility that the stock had gone through in the last two years. That obviously has not changed or subsided, at least yet.

(Source FAST Graphs)

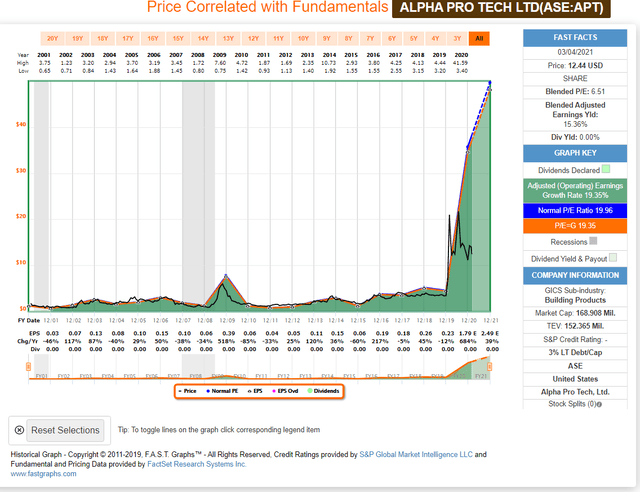

Alpha Pro Tech: Here Is What It Looks Like Today

Even though the price drop has been severe and considering that it is down another 8% or so today, when you look at it on the below graphic and measure it relative to earnings expectations, your perspective might change. The magnitude of the drop as previously stated has been 50%, but relative to the expected earnings growth the stock still looks extremely undervalued. Most importantly, although they might, expectations for earnings for this year and next have not yet changed.

FAST Graphs Friday Analyze Out Loud Video Update from February 9, 2021 Video – Here’s What Alpha Pro Tech Looks Like Now

Summary and Conclusions

One month is too short a time to judge how well this investment has performed. Admittedly, it is off to a rocky start and has been quite unsettling. This company was suggested to me and after reviewing it and researching it I offered it as a compelling speculation and play on the COVID-19 pandemic. The thesis still seems to be intact and only the valuation has changed thus far. However, the fundamentals could change dramatically. Therefore, I believe it is currently prudent to wait a few days until the earnings report comes out before a final decision should be made. Even then if it looks positive, this should be looked at as an interesting speculation. Caveat emptor.

Disclosure: No position.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

SUBSCRIBE to our YouTube Channel