Introduction

Nothing clears the palate of a diehard value investor better than a good old-fashioned bear market. In calendar year 2018 – and especially December 2018 – we were given what I would call a bear market. However, not all bear markets are the same. Sometimes bear markets occur because of a bad economic scenario such as a recession. But that was not the case in 2018. In fact, I could arguably state that 2018 was a great year for the market and a great year for many business enterprises. To my way of thinking, the 2018 bear market is the best kind of all.

Allow me to explain. Many great businesses had become overvalued as we entered calendar year 2018. Consequently, from a value investor’s perspective, many great businesses were not great investments because of excessive valuation. This was especially true with the aerospace and defense subsectors. Moreover, excessively high valuations that started manifesting in 2016 were the exact antithesis of excessively low valuations that we experienced coming out of the great recession of 2008. To summarize, we went from ridiculous undervaluation to unjustified overvaluation almost equally over the course of the last decade. In other words, five undervalued years brought us five overvalued years.

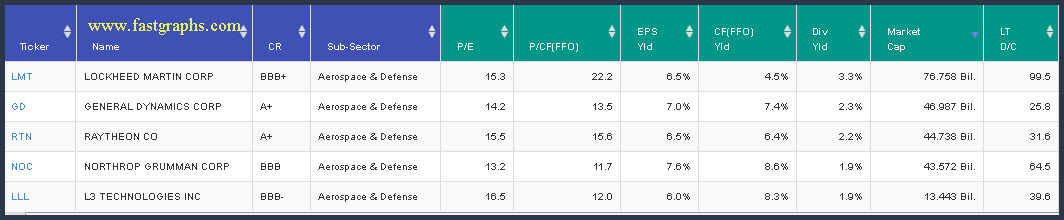

Furthermore, 2018 has potentially delivered the opportunity to invest in a good industry with many excellent companies at valuations that once again makes sense. Therefore, as a twist on the old adage “the best defense is a good offense” – I offer these five best Aerospace and Defense stocks as attractive offensive research candidates for double-digit future returns and above-average growing dividend streams. In other words, I believe these defense stocks are positioned to score a lot of performance points over the next 3 to 5 years.

Portfolio Review: 5 Best Defense (Stocks)

FAST Graphs analyze out loud video: Lessons on Value Investing Lockheed Martin (LMT), General Dynamics (GD), Raytheon (RTN), Northrop Grumman (NOC), L3 Technologies (LLL):

Summary and Conclusions

When stock prices are moving in dramatic fashion either to the upside or the downside, it is very difficult for most investors to see beyond the price action. These five top Aerospace and Defense companies presented in this article and the video represent quintessential examples. In each case the price action of these five strong businesses was horrible in 2018. Consequently, most investors would refer to them as performance dogs over calendar year 2018.

In contrast, I saw the performance of these five great businesses as spectacular in 2018. Earnings growth for each of these five aerospace and defense companies was phenomenal and each of these dividend growth stocks lived up to their names with above-average dividend growth in 2018. In simple terms, each of these companies had great 2018’s from the perspective of operating results. The only problem that each of them was faced with was excessive valuation that ran into a nervous marketplace.

Consequently, the drops in price were justified based on valuations that were higher than fundamentals indicated. However, I did not see this as a bad thing. Instead, I saw it as an opportunity to get offensive with defense stocks. Therefore, I offer each of these businesses as attractive research candidates. I believe they all provide exceptional total returns as a function of above-average capital gains and dividend growth going forward.

Disclosure: Long GD.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.