Introduction

This is the fourth of a five-part series presenting 50 dividend growth stocks that I have screened for current fair value. With this article, I will be covering 10 additional dividend growth research candidates with moderate to higher yields in addition to the initial 30 that I presented in part 1 found here, part 2 found here and part 3 found here.

The first 3 parts of this 5-part series presented high to moderate yielding attractively valued dividend growth stocks. With this part 4 most of the candidates are more oriented to dividend growth investor’s seeking a higher total return. To be clear, most of the research candidates in this group might appeal to investors who are still a few or more years away from retirement. Although dividends are still important to this investor type, portfolio and dividend income growth are more pertinent than a high current yield.

The primary focus on this series of articles is on attractive valuation. Regardless of whether you are investing for growth, current income or income growth, valuation is a universal principle that should be applied with discipline and prudence. However, being disciplined to only invest at fair valuation is more about prudence and controlling risk than it is about generating the highest possible return. Nevertheless, I believe all successful investment strategies should start with the primary focus on identifying fair or intrinsic value.

Furthermore, one misconception that I come across repeatedly is the idea that if the company’s growth rate increases, then so should its fair value multiple. In other words, when a company begins to grow a little faster, it suggests to many investors that it then should automatically command a higher P/E ratio. In my experience, that is not always true. To command a higher valuation than the average company, the company needs to be growing earnings and/or cash flows at a rate greater than 15% per annum. Otherwise, for most companies growing at lower rates, a P/E ratio of 15 universally applies.

The math supporting this above statement is founded on the concept of earnings yield – which is simply the inverse of the P/E ratio. A P/E ratio of 15 provides an earnings yield of 6.67%. In simple terms, this means that if you were entitled to receive all the earnings of the company (you were a 100% shareholder) your return would be 6.67%. This is in line with the long-term return that stocks in the general sense have delivered to shareholders. In my mind, this is a minimum earnings yield that I am willing to accept before I invest in any company.

Later when reviewing the portfolio review listing the 10 stocks in this article, you will see that all but 3 (Comcast Corporation, TFI International and RPM International Inc.) currently provide an earnings yield greater than 6.67%. Regarding the 3 that do not offer an earnings yield over 6.67%, this simply suggests that investors might be wise to patiently wait for a better valuation. Nevertheless, you might also notice that each of them currently trades at a blended P/E ratio greater than 15.

Lockheed Martin Corporation: Another Overvalued Aerospace and Defense Company

In part 3 of this series I showcased the aerospace and defense company General Dynamics Corporation as an example of an overvalued dividend growth stock. With this installment, I offer the competitor Lockheed Martin Corporation (LMT) as an additional example of an overvalued aerospace and defense company. I am specifically choosing examples in this industry because I believe they clearly reflect the importance of valuation as an investment discipline. However, with this article I specifically chose to feature Lockheed Martin Corporation because it speaks to the principles I was discussing in the previous section.

With my first screenshot we are looking at Lockheed Martin Corporation since 1999. Note that the operating earnings growth rate is 10.3% over this timeframe, and the fair value P/E ratio calculation (the orange line) is plotted at 15 across the entire graph. What I really like about this example – as well as the previous General Dynamics example – is how clearly the importance of valuation is reflected.

Once in the throes of the Great Recession we see that General Dynamics was trading at a P/E ratio between 10 to 12 from 2009 through 2013. Since that time the stock price has ascended rapidly, and the current blended P/E ratio has more than doubled to 25. But most importantly, if General Dynamics were to revert to the mean fair value P/E ratio of 15 by the end of this fiscal year, the potential downdraft would be over 33% and annualized close to 42%. This is the risk that investing in or owning overvalued stocks embody.

However, if I shortened the graph to only include fiscal year 2017 and thus far in 2018 and include estimates for 2018, 2019 and 2020, we see that earnings growth is expected to accelerate to 16.2%. Since this expected growth rate is above 15% as previously stated above, the P/E ratio of the orange line is now being drawn at 16.2 or a PEG ratio of 1. To be clear, that is a P/E ratio that is above 15 but consistent with the expected acceleration in Lockheed Martin’s growth going forward. Therefore, it is arguable that Lockheed Martin should command a P/E ratio higher than 15 going forward, but only modestly so. In other words, this accelerated growth potential does not justify a current P/E ratio of 25.

Nevertheless, if Lockheed Martin were to fall to the indicated P/E ratio 16.2 (P/E ratio equal to earnings growth rate) investors would still face the potential for a 28% loss and slightly over 35% annualized. That is not as bad but is still far from being acceptable at least in my eyes. So yes, Lockheed Martin would deserve a higher P/E ratio, but only modestly so. An acceleration in earnings growth does not automatically indicate a higher fair value unless that growth is above 15% per annum. The laws of compounding apply.

Attractive Valuation, Earnings Growth and Dividend Growth Generate Higher Long-Term Total Returns

Valuation is important because it signifies prudence in your investing approach. However, sound valuation alone is not what drives long-term total returns. Investing at sound valuation simply positions you to prudently earn future returns that are potentially consistent with the growth of earnings and dividends that the company you are invested in can generate on your behalf as a stakeholder.

Consequently, once you’ve invested at a sound valuation, your future returns will be functionally related to how fast the company grows earnings and dividends (if it pays one). Stated differently, sound valuation positions you to benefit directly in proportion to the operating capabilities of the company you own. It’s prudent to start with valuation, but your long-term returns will be directly proportionate to how well the business performs. If the business grows at 8% per annum, you can expect 8% capital appreciation plus dividend income. If the business grows at 10% per annum, you can expect 10% capital appreciation plus dividend income, etc.

Of course, the previous statements are predicated on the principle that when valuation anomalies occur (over or under), price will eventually and inevitably move back into alignment with fair value. Therefore, if you invest at fair value and the market overvalues the company in the future, your returns will be greater than what the company generated operationally and vice versa.

In contrast, if you overpay in the beginning, the inevitable P/E ratio contraction will diminish future returns despite the company’s operating success. In other words, you are positioned to earn less than the company is capable of delivering on your behalf.

FAST Graphs Portfolio Review: Next 10 (31 through 40 of 50) by Yield

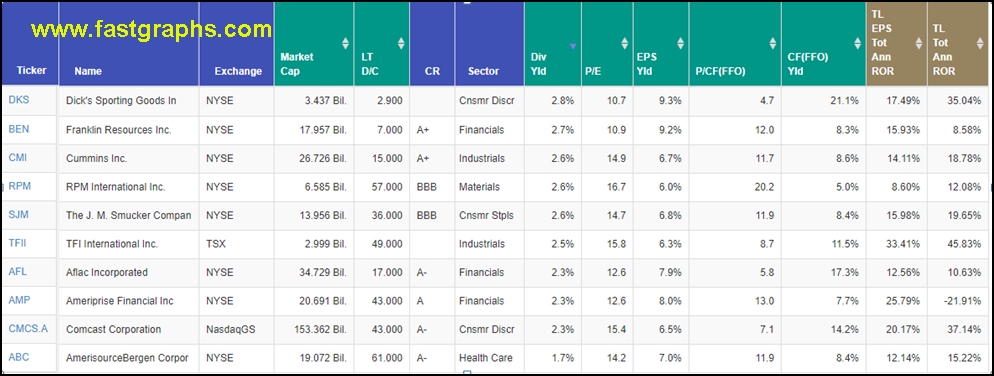

The following portfolio review provides a summary of important metrics for the next 10 fairly-valued research candidates. The reader should note that the last 2 columns (light brown) provide annualized total return estimates based on the consensus 3 to 5 years trend line analyst estimates of either cash flows or earnings. The first light brown column provides total annual return estimates based on earnings, and the second light brown column provides total annual return estimates based on cash flows.

It’s also important that the reader understands that the primary attributes that each of these 10 research candidates have in common is fair valuation coupled with a higher yield than the average company (the current yield of the S&P 500). Moreover, each individual candidate will not necessarily be an appropriate investment for every dividend growth investor. I believe it’s vitally important that each investor builds portfolios according to their own unique goals, objectives and risk tolerances.

Therefore, I suggest that readers might pick and/or choose to examine only those that meet their own personal needs. I will be elaborating more on this important aspect in the FAST Graphs analyze out loud video to follow.

Portfolio Review: Dick’s (DKS), Franklin Resources (BEN), Cummins Inc (CMI), RPM International (RPM), J.M. Smucker (SJM), TFI International (TFII), Aflac (AFL), Ameriprise (AMP), Comcast (CMCSA), AmerisourceBergen (ABC)

FAST Graphs Analyze out Loud Video

In the following video, I will briefly illustrate why I believe each of these 10 research candidates are currently fairly-valued. Additionally, I will provide commentary on what type of portfolio or dividend growth investor they may be appropriate for. Furthermore, a word of caution relative to recent market volatility is also in order. With the stock market fluctuating as much as it recently has been, valuations and current dividend yields are presently very dynamic.

Summary and Conclusions

Disciplined value investing is mostly about controlling risk and general prudence. Consequently, I believe it should represent the foundation of every investing strategy. To me it doesn’t matter if you are investing in growth stocks or dividend growth stocks – valuation should always be a primary consideration. Regarding future returns, once valuation is established, then the potential growth of the business in question will drive your future returns. Therefore, valuation clearly influences your long-term total return, but it is not the only consideration.

Finally, please remember that as a rule (and there are always exceptions to every rule), investors generally face a trade-off between growth and income. This same principle applies to risk. In theory, investors must be willing to take on greater risk to achieve higher rates of return. These principles speak directly to why investors need to invest according to their own goals, objectives, and risk tolerances.

Disclosure: Long DKS,ABC,CMI,AFL,AMP

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.