Introduction

As a value investor, I am totally cognizant of the reality that attractively valued bargains are hard to find in a strong bull market. Moreover, as an experienced value investor I clearly understand that low valuations in a raging bull market are usually associated with issues and challenges sometimes real, sometimes imaginary. The key to success is to identify when current problems are temporary, thereby creating long-term opportunity.

With that said, there are a couple of other aspects of value investing that need to be recognized and understood. As a committed value investor, I will never invest in a stock unless I consider it attractively valued. With extremely high quality companies this can simply mean that valuation needs to be sound or reasonable. With less-than-stellar companies, valuations need to be extremely low to be of interest. Nevertheless, I will never knowingly overpay for even the best of businesses. On the other hand, just because a company is fairly valued doesn’t automatically make it investment worthy.

My point being that although attractive valuation is a critically important investment consideration, it is not the only consideration. From this perspective, valuation is primarily a risk assessment metric more than it is a return assessment. Furthermore, I believe that a comprehensive and thorough research and due diligence effort should be conducted before ever investing in any common stock. However, that requires time and effort on the part of the investor.

Consequently, I will not waste my time or take this important step unless I believe that valuation is attractive enough before I start. To me, as a committed value investor, there is little that is more frustrating than getting all excited about a possible stock investment only to determine that its current valuation is excessive. Unfortunately, it is hard to find attractively valued best-of-breed stock investments when markets are high like they are today. Unless, of course, the company is faced with issues that Mr. Market is concerned about.

On the other hand, there is nothing a value investor likes better than finding a great business that the market is punishing unjustly. Finding a great business that is undervalued is value investing nirvana. In his 1994 annual report Warren Buffett stated this succinctly as follows: “Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist.”

To summarize this introduction, finding a great business on sale is a fundamental objective of value investing. However, investing in stocks that meet your specific investment objective is also a sound fundamental practice. In other words, a great stock can be discovered at an attractive valuation and still not be appropriate for your portfolio. For example, you might ignore or reject a non-dividend paying growth stock at attractive value because your investment objective is income. This represents another situation where just because a stock is available at an attractive valuation doesn’t necessarily imply that it’s a good fit for your portfolio.

Cardinal Health: A Great Business On Sale?

As I have matured, my investment objective has evolved from attempting to achieve maximum total long-term returns to achieving a reliable and growing dividend income stream to supplement my income. Consequently, I am actively looking for attractively valued dividend growth stocks offering dividend yields of 3% or better. This 3% dividend yield goal is not arbitrary. For starters, 3% is an above market dividend yield, and secondarily, a yield level that exceeds my income needs. Therefore, my dividend income meets my needs without ever having to harvest principle (shares). This solidifies the opportunity to receive more dividend income through future dividend increases.

Moreover, as stock values have become more and more extended, especially on the majority of high-quality dividend growth stocks (such as Aristocrats and Champions), finding attractively valued blue-chip dividend growth stocks offering yields of 3% or better has become very challenging. In markets like we have today, there is usually a negative catalyst or catalysts associated with attractive valuations. As previously stated, the trick is to find companies that are either being misappraised by the market, or when the market is overreacting to the negative catalysts.

Cardinal Health Inc. (CAH) is a Dividend Aristocrat that has increased its dividend for 32 consecutive years and is currently yielding 3.3%. But perhaps most importantly, I believe the company is worth in the neighborhood of $75 share and is currently available in the mid-50s. Consequently, I believe it offers the rare combination of above-average and growing current yield with the opportunity to generate above-average capital appreciation over the long run and perhaps the short run as well.

To be clear, I believe that Cardinal Health is facing short-term issues that have recently generated weak earnings and cash flows. However, I also believe that the market is currently punishing the company’s stock price more than it deserves. Consequently, I suggest that Cardinal Health is an extremely undervalued and therefore attractive Dividend Aristocrat on sale. Furthermore, I do believe the company possesses above-average long-term growth potential. As a result, I would expect above-average longer-term total returns resulting from growth coupled with P/E ratio expansion. But best of all, Cardinal Health meets my current investment objective because it provides an above-average current dividend yield coupled with above-average dividend growth.

Additionally, it’s also important to point out that my investing strategy and objective is long-term buy-and-hold oriented. As a value investor, I understand that purchasing out-of-favor stocks can often lead to disappointing short-term performance. On the other hand, as a value investor I also understand that purchasing out-of-favor stocks can lead to enhanced long-term total returns at reduced levels of risk. In other words, my investment horizon is at a minimum 3 to 5 years (a typical business cycle) and preferably forever. As an experienced value investor, I have learned that it takes time for a business to increase its intrinsic value. Frankly, it’s a lot easier to be patient when the business is paying you lavishly while you wait.

Cardinal Health: Investment Thesis

Once I have identified attractive valuation via FAST Graphs, my next step is to conduct some preliminary research. Therefore, I will look to outside sources such as Morningstar and/or Zacks to see what they have to say about the company. Morningstar analyst Vishnu Lekraj in an analyst note on November 6, 2017 stated that “Cardinal is one of the most critical players along the pharmaceutical supply chain. The following excerpts provide additional insights into Morningstar’s view of Cardinal Health:

“While the firm’s results for the quarter were not stellar, we don’t believe they reflect the wholesaler’s long-term position. Accordingly, we are reiterating our wide moat rating and $84 fair value estimate for Cardinal. Pressuring the firm’s core pharmaceutical segment was a resetting of its generic portfolio pricing. Over the last year, many independent pharmacy clients have demanded lower generic pricing from their respective pharmaceutical wholesalers and Cardinal’s two main rivals (Amerisource and McKesson) have had to reprice a material portion of their group purchasing contracts as a result. We believe there has been somewhat of a lag of this trend for Cardinal, which is why its results this quarter were below its peers.”

After acknowledging some of the issues facing Cardinal Health and its competitors, Morningstar highlighted Cardinal Health’s wide moat as follows:

“Out of all the numerous players along the pharmaceutical supply chain, Cardinal stands out as an elite participant. We believe the firm possesses a wide economic moat, as it is able to turn its significant size and market share into key competitive advantages. Cardinal also plays a critical role within the pharmaceutical industry, given that many supply-chain participants depend on its services for streamlined product distribution and procurement. We expect the use of pharmaceuticals to increase over the next several years, which should provide a solid platform for Cardinal’s continued success.

Cardinal has also made a few strategic moves that we believe will be beneficial over the long term. For one, it signed an agreement with CVS Caremark where the two firms will combine generic sourcing operations. This should allow it an opportunity to enhance profitability, as the combined sourcing entity will be able to garner greater pricing discounts from generic manufacturers.

Cardinal is the third-largest pharmaceutical distributor by revenue and is the main supplier to CVS Health’s retail pharmacy network. The firm also supplies several large provider GPOs and mass retailers. The razor-thin profitability of these contracts and the enormous amount of capital needed to build a top-tier global drug wholesaling/distribution operation have formed a solid competitive foundation for Cardinal that has largely kept new entrants at bay.”

Therefore, at this cursory level of research and due diligence, Morningstar corroborates my thesis that Cardinal Health is undervalued. However, Zacks Research also provided additional insights that further corroborate my thesis:

Zacks summary:

“Over the last year, Cardinal Health has underperformed the broader industry with respect to price. Increasing generic pricing pressure is a major headwind. Intensifying competition and customer concentration are other bottlenecks. A sluggish macroeconomic scenario and tough product pricing environment are likely to impede growth. Meanwhile, the company is banking on strategic buyouts, joint ventures and supply agreements to drive growth. A solid fiscal 2018 guidance instills our confidence in the stock. Also, Cardinal Health ended first-quarter on a solid note, courtesy of an encouraging performance at the Medical segment. Although, the Pharmaceutical segment witnessed strong growth in the Specialty business and gained a huge number of Pharmaceutical Distribution customers, profits at the segment were hurt by generic pharmaceutical pricing and the loss of a major Pharmaceutical Distribution customer.”

As is Zacks custom in their research reports they also offer reasons to buy and reasons to sell as follows:

“Reasons to Buy:

Acquisition Drives Growth: Cardinal Health follows an acquisition-driven strategy and continues to focus on investment in key growth businesses to gain market traction and boost profits. Cardinal Health announced that it has completed the acquisition of Medtronic’s Patient Care, Deep Vein Thrombosis and Nutritional Insufficiency business for $6.1 billion. The Patient Care, Deep Vein Thrombosis and Nutritional Insufficiency business operates across 23 product categories in multiple market sites of care, like industry-leading brands of Curity, Kendall, Dover, Argyle and Kangaroo – brands used in nearly every U.S. hospital. Cardinal Health expects the acquisition to be accretive to adjusted earnings by more than $0.21 per share in fiscal 2018.

The company has recently entered into an agreement to buy the radioactive diagnostic drug Lymphoseek from Navidea Biopharmaceuticals. In fact over the last five years, the company has spent approximately $5.7 billion on acquisitions of the likes of Cordis (2015), The Harvard Group (2015), AccessClosure (2014), AssuraMed (2013), Kinray (2010), Cardinal Health China (2010) and Healthcare Solutions Holding (2010). These have considerably boosted the company’s offerings in diversified fields. The Cordis takeover will expand the company’s global footprint over the long haul. Cordis along with AccessClosure will boost the company’s portfolio of self-manufactured products under the Medical segment. The Harvard Group deal not only expands Cardinal Health’s product portfolio but also its existing telesales programs and capabilities. We believe the company will continue to pursue acquisitions which are strategic fits and will also diversify its revenue base over the long term.”

Cushioned Against Macroeconomic Sluggishness: Large-cap, diversified healthcare distributors such as Cardinal Health are relatively insulated from macro economic uncertainty and a weak economy. Cardinal Health is one of the largest distributors of pharmaceuticals and medical supplies. It has a diversified product portfolio, which is a hedge against the risk of sales shortfall in testing times. The company’s generics business continues to show healthy growth, supported by a solid customer base, significant scale of operation and the competence to source products from a complex and global supply network. Cardinal Health has rationalized the number of generic suppliers. In addition, the company has expanded relationships with generic manufacturers that include several benefits like higher service levels, greater clarity on generic cost of goods sold, and a more consistent product supply with fewer disruptions.

Long-term Supply Agreements Buoys Optimism: Cardinal Health is also pursuing growth via joint ventures and long-term supply agreements with several firms. The company entered a long-term strategic agreement with Henry Schein in 2014, under which the latter will purchase Cardinal Health’s medical supplies for physician practices. The collaboration is expected to drive core sales and prove accretive to Cardinal Health’s earnings in the long term. The signing of a 15-year agreement with Bayer Healthcare for the contract manufacturing of Xofigo is significantly positive. In our opinion, this will help the company leverage its expertise in the nuclear pharmacy industry to expand access to a therapeutic agent and increase the use of radiopharmaceuticals in the U.S. and Canada. The Red Oak Sourcing joint venture with CVS Health, which will negotiate generic pharmaceutical supply contracts on behalf of both companies, also holds significant long-term prospects for Cardinal Health.

Good Client Retention: The performance of Cardinal Health’s Pharmaceutical segment has been facilitated by good client retention, with the loss of only a few key customers (Walgreens and Express Scripts). Cardinal Health has already renewed many of its chain customer contracts for subsequent years. The concentration of suppliers has also been well managed by the company.

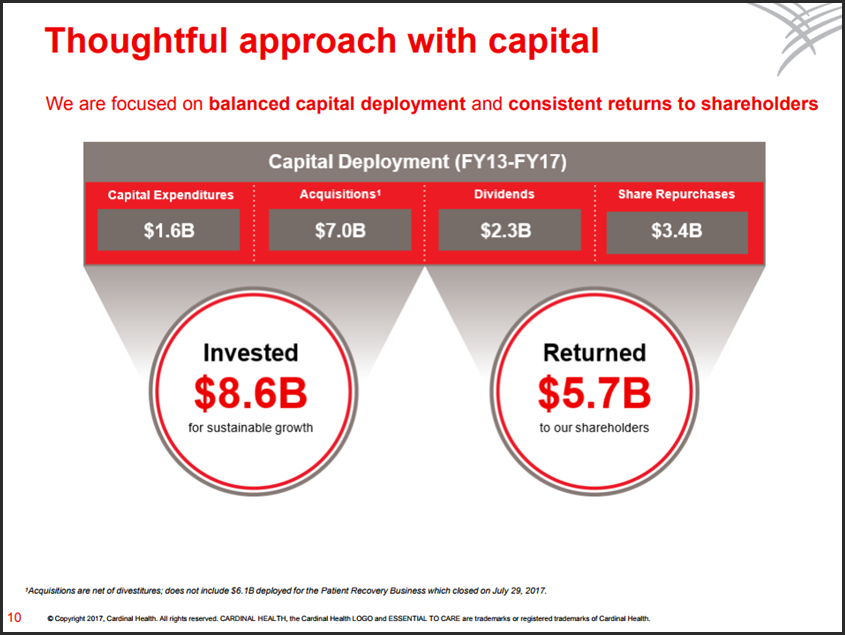

Strong Balance Sheet: Cardinal Health’s strong balance sheet and cash flow enable it to pursue growth opportunities and accretive acquisitions. The company uses its cash flow to return value to investors in the form of dividends and share repurchases. In fiscal 2017, the company returned more than $1.2 billion to shareholders through stock repurchases and dividend payouts. Aggressive share buybacks will boost earnings as well as shareholders’ value over the long run. In fiscal 2017, operating cash flow at the company was $1.2 billion, of which $387 million was deployed in capital expenditures.

Reasons to Sell:

Share price movement: Cardinal Health stock price has significantly underperformed thus far in 2017.

Probabilities of Loss of a Major Customer Worrisome: Collectively, 5 of Cardinal Health’s main customers, including CVS, accounted for as much as 40% of its revenues.

Group Purchasing Organizations: Cardinal Health derives a significant quantum of revenues through agreements with group purchasing organizations (GPO’s). The company’s largest GPO agents are Asembia, HealthTrust, Innovatix,Intalere, Premier Purchasing Partners and 6 others. Loss of any of these agents with severely affect the company sells.

Integration Risks: Cardinal Health continues to acquire a large number of companies. This improves revenue but also adds integration risk.

Cutthroat Competition in Niche Space: Cardinal Health faces tough competition in each of its business segments.”

By screening the Standard & Poor’s Dividend Aristocrats via FAST Graphs looking for attractive value, Cardinal Health was one of only 7 Dividend Aristocrats that appeared reasonably valued. After reviewing research from Morningstar and Zacks I concluded that Cardinal Health was a stock worthy of conducting a more comprehensive research and due diligence process on. Consequently, my next step is to run it through a comprehensive fundamental valuation analysis utilizing the numerous earnings and cash flow metrics available FAST Graphs.

Cardinal Health Inc.: FAST Graphs Analyze Out Loud Valuation Analysis

The following analyze out loud video will present a quick overview of Cardinal Health Inc. based primarily on price relative to earnings and cash flow. However, as discussed above, I will also evaluate several other metrics. For any reader concerned with the current valuation of Cardinal Health Inc., this video is a must watch. Furthermore, although I will be only providing a cursory, or a pre-more comprehensive due diligence analysis, I believe you will find the video enlightening and hopefully entertaining.

Summary and Conclusions

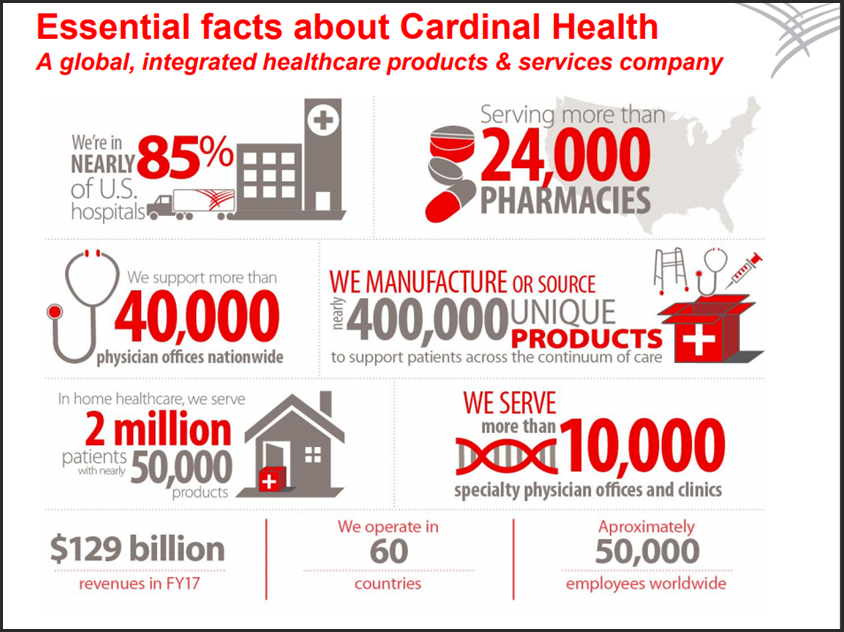

Cardinal Health is a powerhouse in its respective industry. It is the second-largest by market and third-largest by revenues and one of three major pharmaceutical distributors in the US. Yes, it’s true that the company – and in fact its entire industry – is currently out-of-favor with Mr. Market. Nevertheless, the following slide from Cardinal Health’s recent annual meeting of shareholders on November 8, 2017 summarizes the breadth and depth of Cardinal Health’s business:

Although there is certainly a significant amount of perceived risks associated with investing in Cardinal Health or the pharmaceutical distribution industry in general, I believe that the risks are already reflected in the price. Cardinal Health is aware of the changing healthcare landscape and is taking steps to maintain their relevance and profitability. The following slide depicts Cardinal Health’s commitment to shareholders and to continuing to support future growth:

In conclusion, I believe that Cardinal Health represents an intriguing investment opportunity given the state of today’s stock market. The company and its entire industry are currently out-of-favor with the market. However, I contend that Cardinal Health’s low valuation mitigates much of the risk associated with investing in it while simultaneously provides the opportunity for enhanced long-term returns. Consequently, whether your investment objective is high current income and dividend growth or above- average total returns Cardinal Health might deserve a closer look.

Disclosure: Long CAH at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.