Introduction

This article is going to deal with growth stocks and how to value them. First of all, it’s important to point out that growth stocks are very different than ordinary stocks. Growth stocks need to be thought about differently, because they possess powerful attributes that their more ordinary cousins do not. Even though this is true, the underlying principles of valuation will still apply. Just like any stock, a growth stock receives its value from the amount of cash flows it is capable of generating for its stakeholders. Because of the high velocity of their earnings growth rates, true growth stocks will generate future streams of income that are multiples larger than those of the ordinary or average company.

However, because the dynamics of these companies are so extraordinary, they require their own special intrinsic value formula to capitalize those cash flows. The most commonly applied formula for growth stocks is the price equals growth rate, or PEG formula. Therefore, later when we review these companies with our “fundamentals at a glance research” tool, F.A.S.T. Graphs, earnings and price will be graphed utilizing the PEG formula. Additionally, we would like to point out that we discovered through trial and error, that a PEG ratio formula for valuing a company begins to max out at a PE of 30. This does not mean that high-growth stocks will never trade at a higher PE ratio, instead this is just a caveat that anything over 30 times earnings should be thought of as fully or even perhaps overvalued.

At this point, a clear definition of what a growth stock is, at least in our opinion, is in order. For us to consider a company a true growth stock, the company must possess at least a five-year history of extraordinary growth in its underlying business. Our minimum threshold will be a rate of change of earnings growth of 15% or better. However, as you will see, most of the companies examined in this article will have achieved earnings growth far in advance of our minimum threshold. It’s important for the reader to understand that our focus is on business growth rather than price action. Therefore, we are not forecasting where the stock price may or may not go, instead, we are endeavoring to determine the true worth or value of the business itself, based on the amount of cash flow (earnings) it generates for shareholders.

The following nine examples represent an eclectic compilation of growth stocks (based on our above definition of a growth stock), with historical earnings growth rates ranging from approximately 20% to over 90%. We ask that the readers keep in mind that this is a historical analysis that illustrates the power of above-average earnings growth over time. As you’ll see, each of these super growth stocks has generated shareholder returns that are so far in excess of the ordinary, as to not even relate. Frankly, we don’t expect any of these companies to be capable of continuing to grow at their historical levels. On the other hand, based on consensus forward earnings estimates, each of these companies are expected to continue to grow future earnings at significantly above-average rates.

We are going to present these super fast growth stocks through the lens of our graphs research tool in four sets of two. We will start with the lowest earnings growth rates and progressively move up to higher and higher earnings growth rates. Our fifth and last example will contain the champion growth stock of the group, based on historical compound earnings growth, since calendar year 2004. We chose this seven-year time frame (eight year graphs that include one year of forecast) for two primary reasons. One, we wanted to review companies that met our definition of above-average earnings growth for at least five years running. Two, we wanted to examine a timeframe that was long enough to illustrate the enormous compounding power of very fast earnings growth.

Since most of these companies are well known, we will spare the reader a detailed analysis on each specific company. Instead, we will look at these companies purely through the lens of our research tool, by the numbers. We will produce four graphs on each company. First, we will graph earnings and dividends only (if any) since calendar year 2004. Second, we will overlay price and the historical normal PE ratio correlated with earnings. Third, we will provide the calculated performance results for each company based on the price and earnings correlated graphs. Fourth, we will provide a forecasting calculator based on the consensus of analysts reporting to either FirstCall or Zacks.

Two examples of historical earnings growth greater than 20% per annum:

Medco Health Solutions Inc. (MHS) and HDFC Bank Ltd. (HDB)

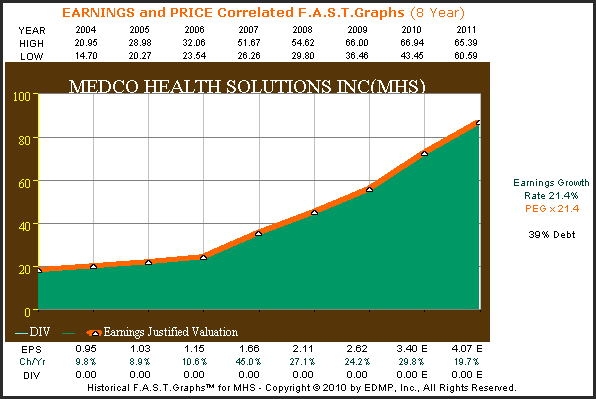

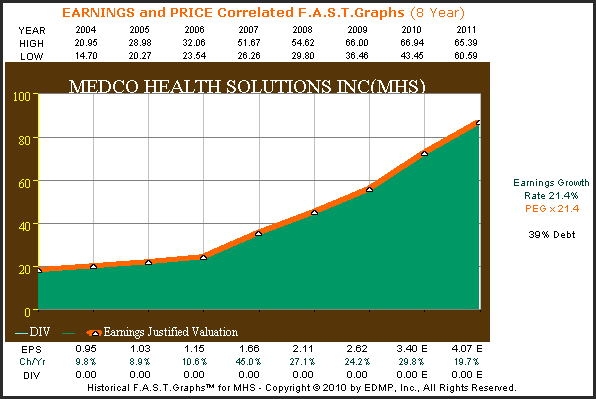

Medco Health Solutions is the country’s largest pharmacy benefit manager which was spun off from Merck & Co. in August of 2003. As you can see from the earnings only graph below, Medco has consistently increased their earnings at a compounded rate of over 21% per annum since their public debut. When we examine this company devoid of stock price, we find a very smooth and consistent record of above-average earnings growth.

(Click to enlarge)

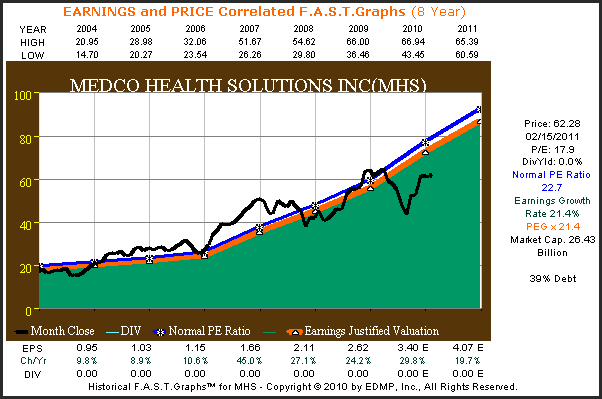

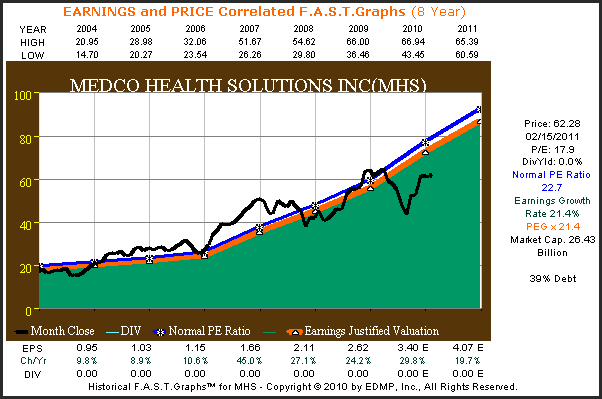

(Click to enlarge)When monthly closing stock prices are added to Medco’s graph, we see a strong correlation between price and earnings growth. Notice how this company went through the recession of 2008 without even a hiccup regarding their earnings growth. But most importantly, notice how stock price has tracked earnings over time with expected minor bouts of volatility along the way.

(Click to enlarge)

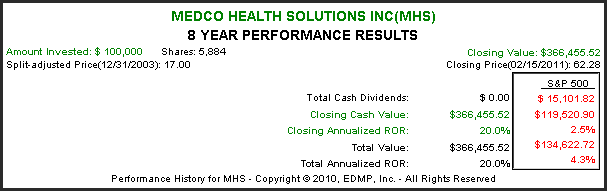

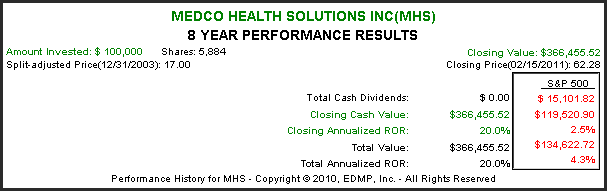

(Click to enlarge)Medco’s strong above-average earnings growth has translated into a highly correlated shareholder return of just under 20% per annum. As a pure growth stock, this exceptional company has generated strong above-average returns for their shareholders, even absent a dividend.

(Click to enlarge)

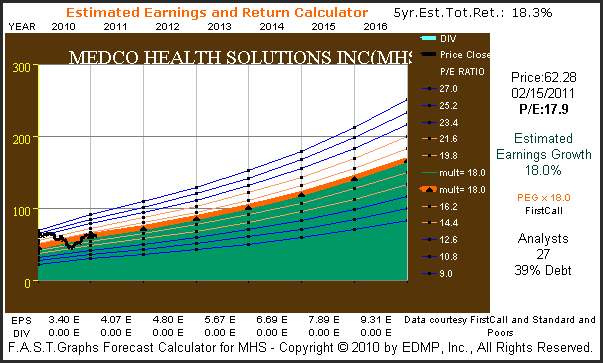

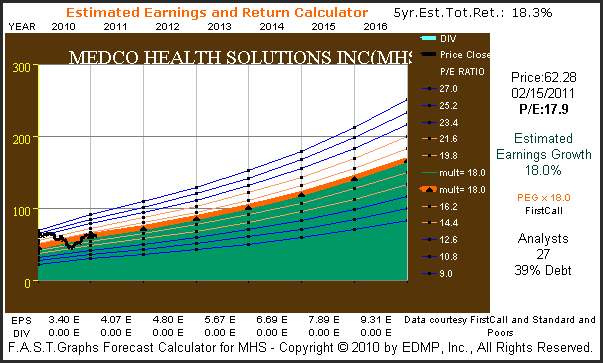

(Click to enlarge)The consensus of 27 analysts reporting to FirstCall, expect Medco Health Solutions to continue to grow at an above-average rate of 18% over the next five years. Assuming these consensus estimates are correct, then Medco Health Solutions is currently trading at a PEG ratio of one, implying that it’s currently fairly valued.

(Click to enlarge)

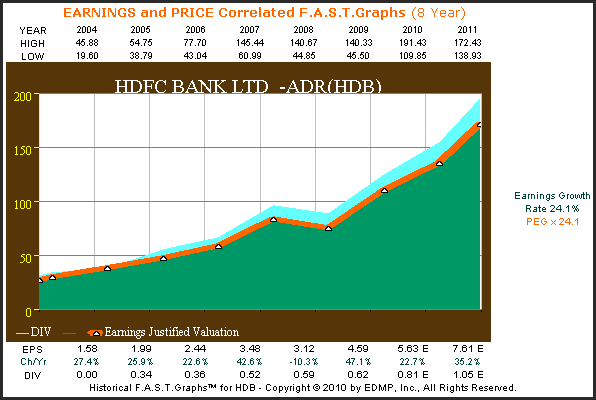

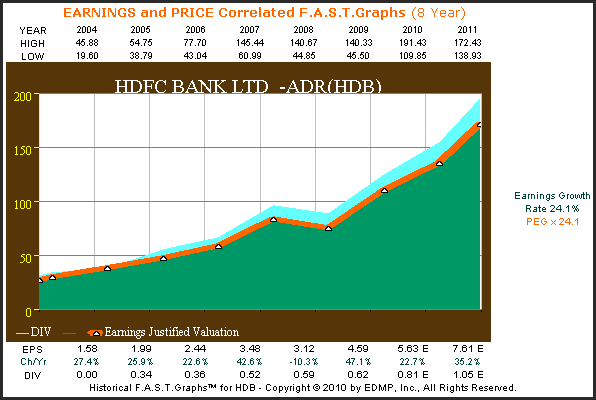

(Click to enlarge)HDFC Bank Ltd. is an India-based bank traded as an ADR on the New York Stock Exchange. This well-managed foreign bank has increased earnings at the above-average rate of over 24% per annum, with only a mild earnings drop experienced during the worldwide recession of 2008. Note that this company does pay a modest, but growing dividend (light blue shaded area).

(Click to enlarge)

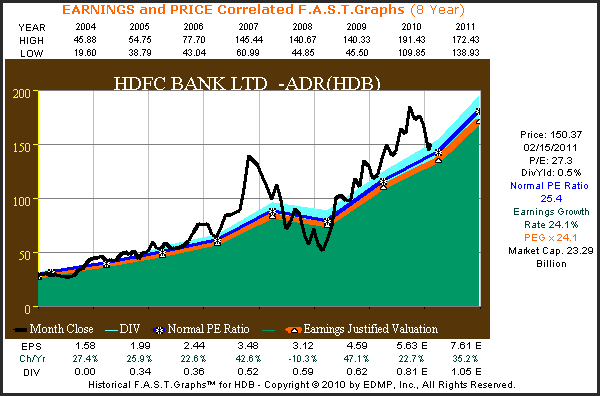

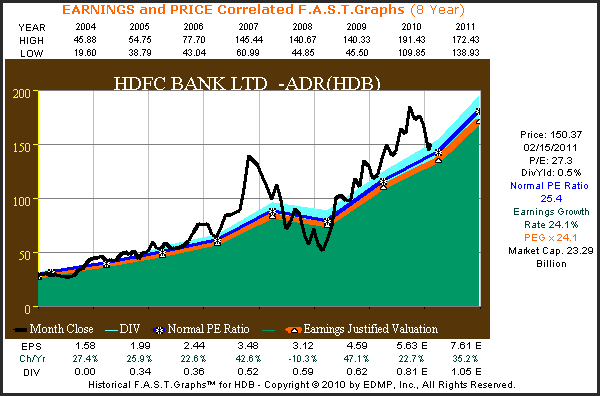

(Click to enlarge)When monthly closing stock prices are correlated with earnings, we find that HDFC Bank Ltd. has commanded a normal PE ratio more or less equal to their earnings growth most of the time. Therefore, this company has historically commanded a PEG ratio of approximately 1. Note the importance of valuation depicted by the graph below, illustrating that every time price became disconnected from earnings justified levels (orange line), either over or under, price inevitably moved back to fair value.

(Click to enlarge)

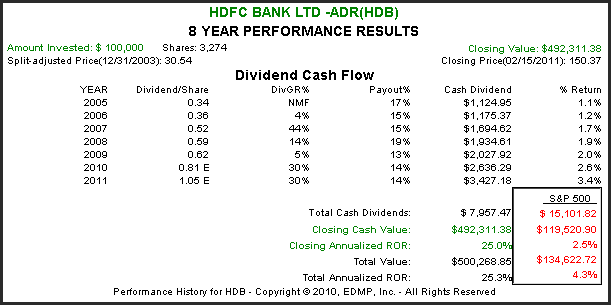

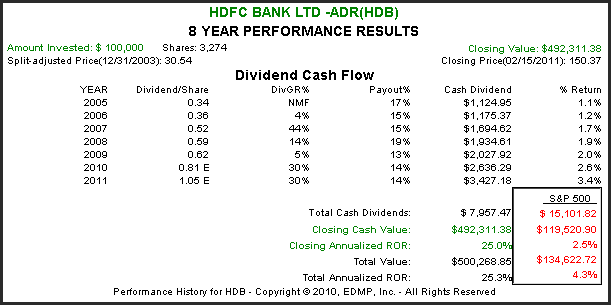

(Click to enlarge)HDFC Bank shareholders were rewarded in almost perfect proportion to the company’s achieved earnings growth rate since calendar year 2004. This is due to the combination of earnings growth and True Worth valuation at the start and end of the time period measured. As a growth stock, notice how shareholder returns are predominately generated from capital appreciation based on earnings growth with only a modest contribution from dividends. However, even though their dividend yield is quite modest, it has increased at a very fast rate.

(Click to enlarge)

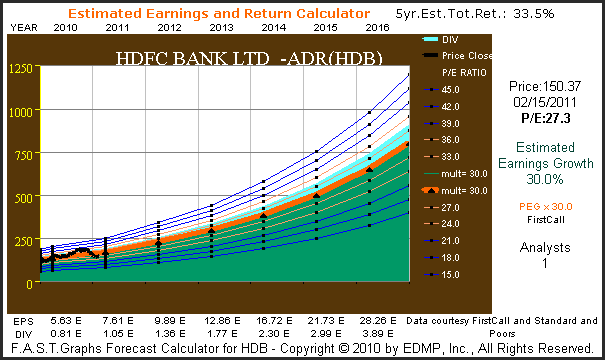

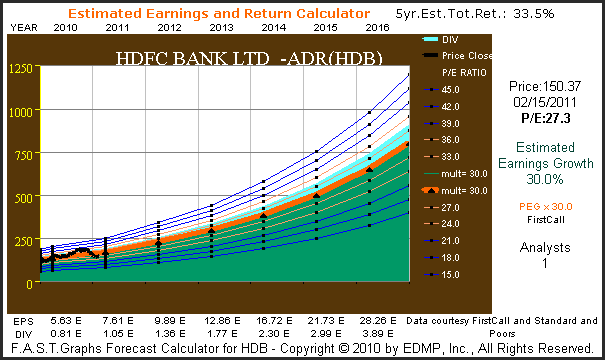

(Click to enlarge)India, HDFC Bank Limited is headquartered in Mumbai, India and trades on the New York Stock Exchange as an ADR. There is only one analyst reporting to FirstCall, however, his forecast is for estimated five-year earnings growth of 30% per annum. If this estimated earnings growth rate is achieved, HDFC Bank Limited would be trading at a PEG ratio slightly below one.

Additionally, the $7.61 earnings estimate for 2011 represents a 35.2% forecast growth rate. However, with only one analyst reporting, prospective investors are encouraged to perform their own due diligence and come up with their own forecast.

(Click to enlarge)

(Click to enlarge)The two examples above show how the PEG ratio formula for valuing a company is very relevant for companies growing between 15% to 30% per annum. However, as you will soon see, when growth rates exceed 30% per annum the PEG ratio formula begins to show less correlation. We have assumed that this is most likely due to a general skepticism that a company cannot continue to grow at such high rates indefinitely. Consequently, as a general rule, we have tended to max the fair value PE ratio for even extremely fast-growing companies at 30. However, this is not to say that any PE ratio above 30 is too high, because we will soon see examples where a company purchased at a higher PE ratio has still rewarded investors handsomely. On the other hand, it would be naïve to think that high returns achieved from paying more than 30 times earnings were generated without great risk.

Historical earnings growth greater than 30% per annum:

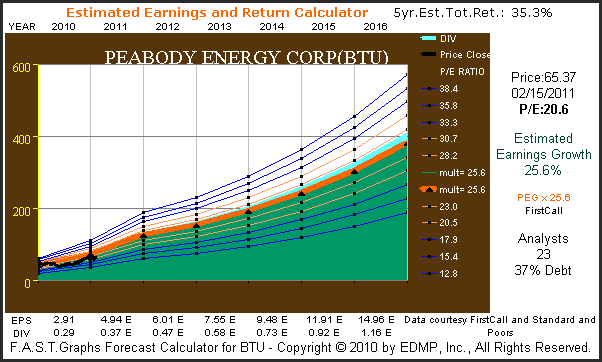

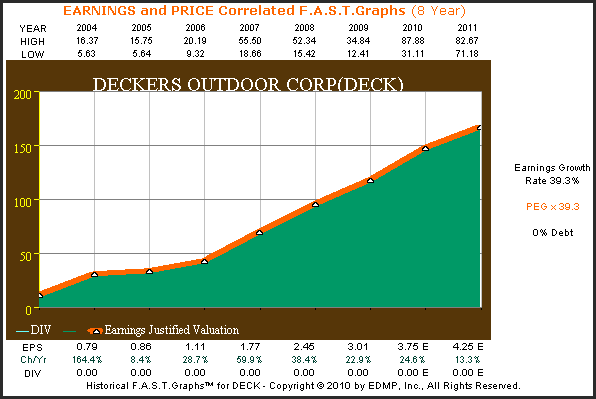

Peabody Energy Corp. (BTU) and Deckers Outdoor Corp. (DECK)

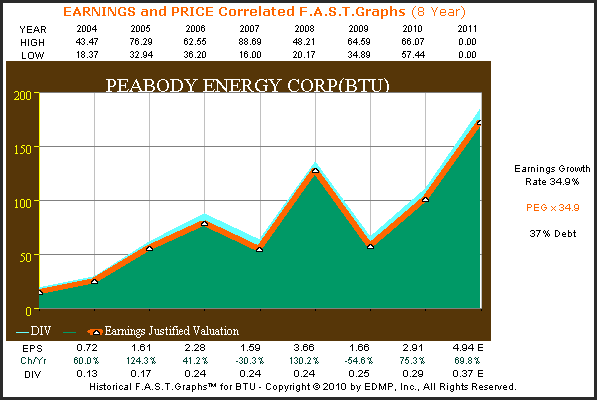

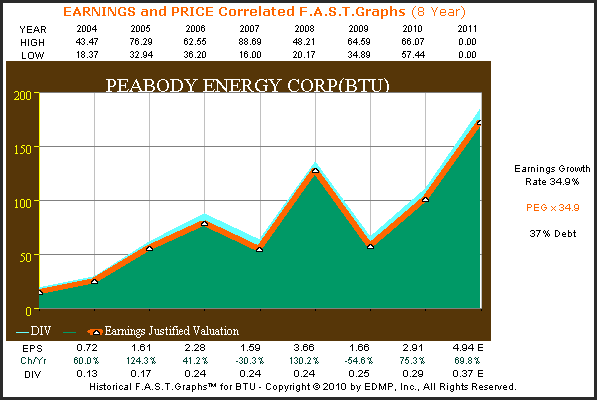

Peabody Energy Corp. is the largest privately owned coal company in the world. Although earnings growth has been somewhat more cyclical than the previous companies we’ve observed, it has nevertheless been exceptional and above average. Notice how the graph provides an instantaneous and comprehensive perspective of the company’s operating history.

(Click to enlarge)

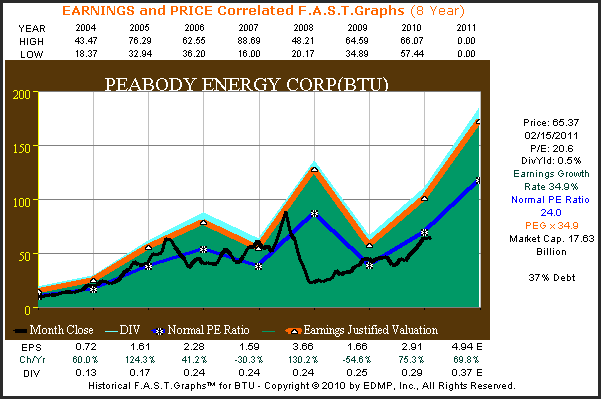

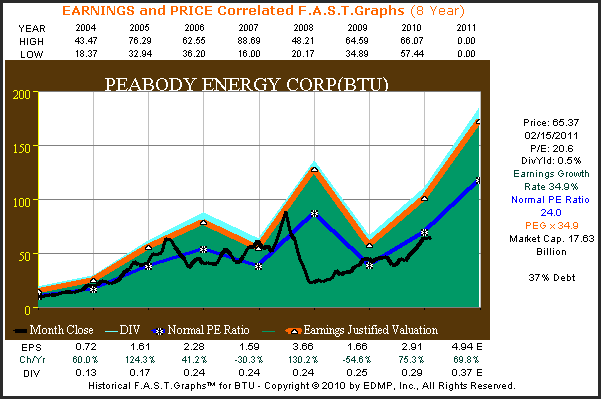

(Click to enlarge)Perhaps due to the cyclicality of their earnings history, Peabody Energy has traded at a normal PE ratio of approximately 24 even though their earnings growth has been in excess of 34% per annum. Although this does not perfectly fit the PEG ratio formula, it becomes a very relevant piece of information for the prospective investor to know. The company does pay a dividend, albeit a very modest one.

(Click to enlarge)

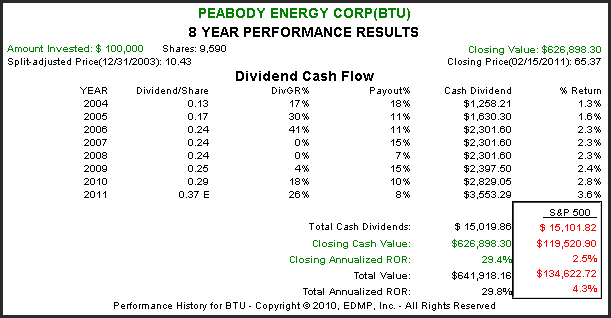

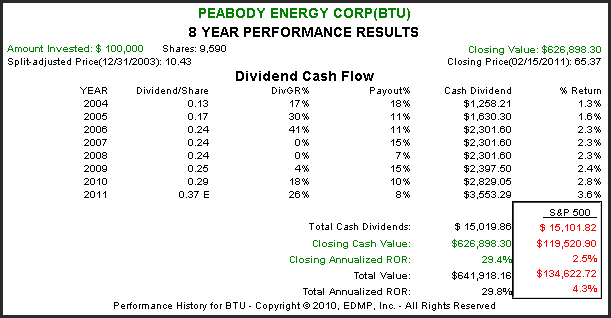

(Click to enlarge)Even though Peabody Energy has traded at a PE ratio that’s lower than their growth rate, shareholder capital appreciation represents a very close approximation of their earnings growth. Their small but growing dividend has slightly added to their total return, but clearly this has been primarily a growth story.

(Click to enlarge)

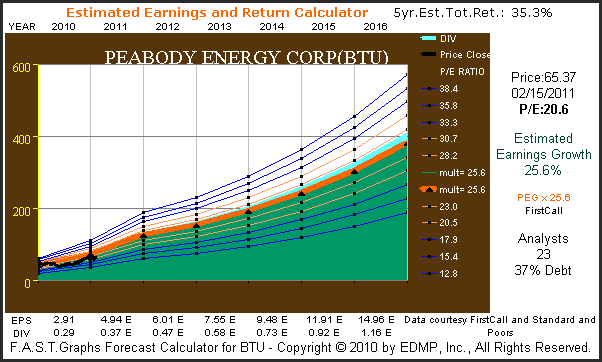

(Click to enlarge)The consensus of 23 analysts reporting to FirstCall, expect Peabody Energy to continue growing earnings in excess of 25% per annum. Therefore, their current PE ratio of just less than 21 represents an attractive valuation, assuming they achieve these expected growth rates.

(Click to enlarge)

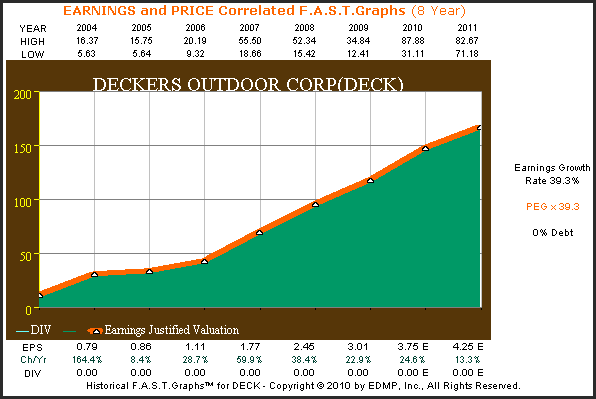

(Click to enlarge)Deckers Outdoor Corp. is a manufacturer and designer of high quality footwear. Currently they are best known for their popular UGG brand of boots. Deckers Outdoor Corp. has no debt on their balance sheet, and has grown earnings at over 39% per annum since calendar year 2004. However, notice by the horizontal column Ch/Yr (change per year at the bottom of the graph) that their first year’s earnings growth rate was 164.4%. Obviously, this skews the results to a higher average than it would be without this aberrant value. Take this first number out, and the earnings growth rate drops to approximately 27%. This represents an example of what we mean when we say that our graphs are “tools to think with.”

(Click to enlarge)

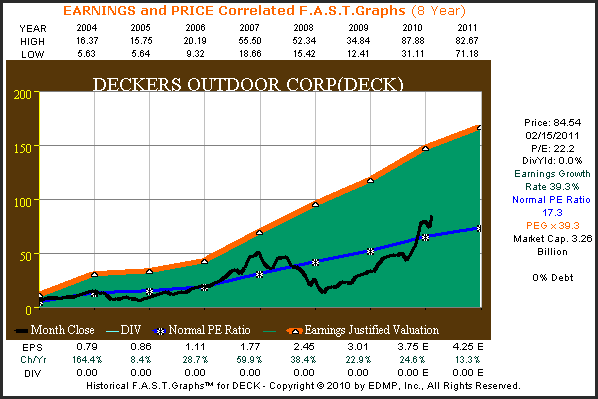

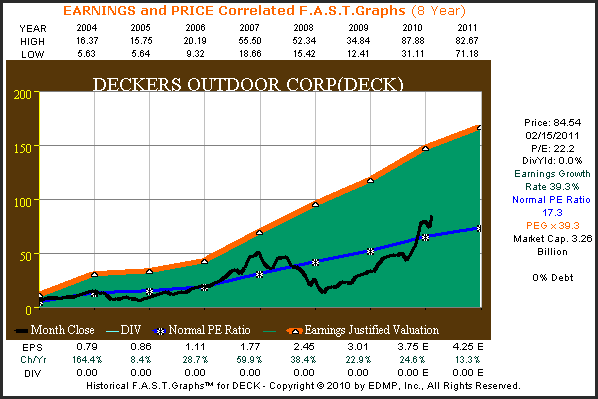

(Click to enlarge)Perhaps because of the industry they are in, the market has historically awarded their shares a normal PE ratio that has been lower than their earnings growth rate. Also, even though earnings growth has been reasonably consistent on a trend line basis, the company’s earnings record does experience bouts of very high growth coupled with bouts of just barely above-average growth. This, more than likely, also contributes to a PE ratio which is discounted below their average earnings growth rate.

(Click to enlarge)

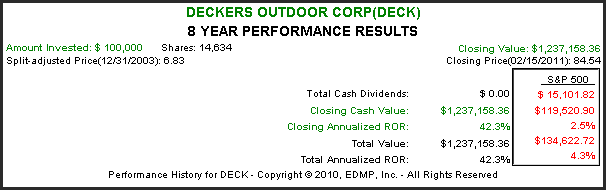

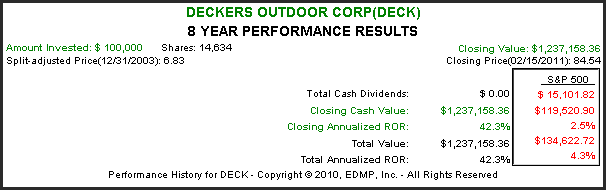

(Click to enlarge)With the recent success of Deckers’ hot brand, the popular UGG boot line, their stock price currently enjoys a valuation that is higher than their historical norm. Consequently, shareholders have enjoyed an exceptional compounded rate of return exceeding 40% per annum since calendar year 2004. With no dividend, these exceptional results are pure growth related.

(Click to enlarge)

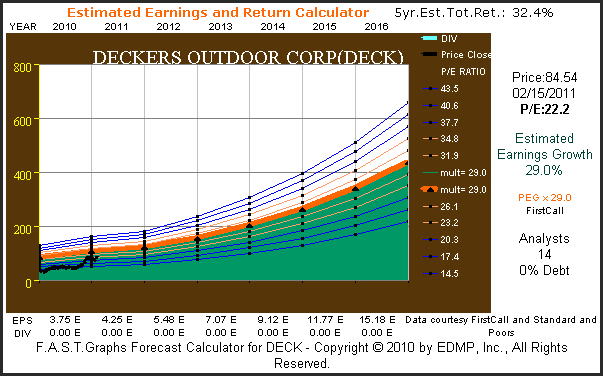

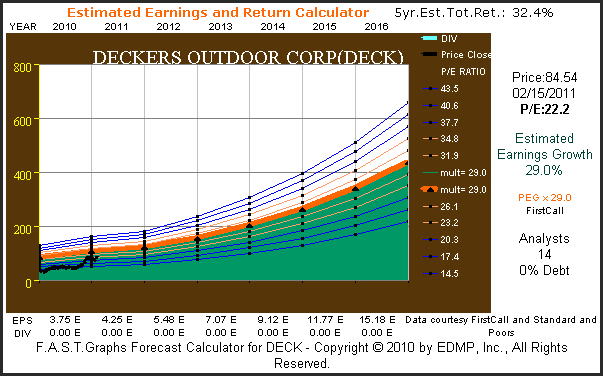

(Click to enlarge)The consensus of 14 analysts reporting to FirstCall, expect Deckers to grow future earnings at the exceptional and above-average annual rate of 29% per annum. Even though this is below the 30 limit which would imply fair value at the PEG ratio formula calculation, historical precedent implies that this number would be too high. Therefore, it would be logical to assume that their normal PE ratio of approximately 17 would make more sense. The second blue line from the bottom on the estimated earnings and return calculator below represents a close approximation to their historical normal PE. This would still mathematically imply a year-end 2016 fair value price of over $260 per share.

(Click to enlarge)

(Click to enlarge)Peabody Energy and Deckers represent two examples of companies that have grown earnings in excess of 30% per annum. However, as previously mentioned, the market has chosen not to historically capitalize either company at their achieved growth rate of earnings. On the other hand, the shareholders of both companies have enjoyed returns that have closely correlated to each company’s success in growing earnings. This is another real advantage of our research tool, in that it provides a perspective of normal valuation. Therefore, investors can utilize this knowledge in order to make intelligent decisions, and not just be blinded by mere statistical fact, no matter how exciting it may appear by the numbers alone.

Two examples of historical earnings growth greater than 40% per annum:

Chipotle Mexican Grill Inc. (CMG) and Intuitive Surgical Inc. (ISRG)

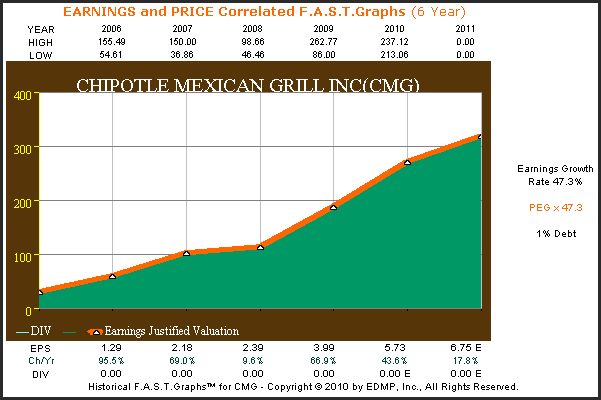

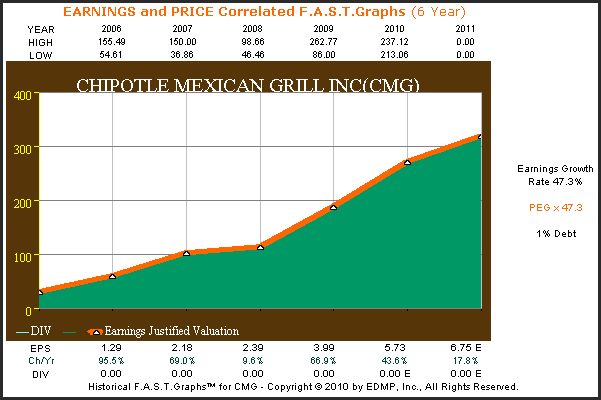

Capote Mexican Grill is one of the hottest operators and developers of the fast food, casual dining Mexican restaurant group. This company was privately owned by McDonald’s Corp. until it went public in early 2006. Since its initial public debut, this company has consistently grown earnings at an exceptional rate exceeding 40% per annum.

(Click to enlarge)

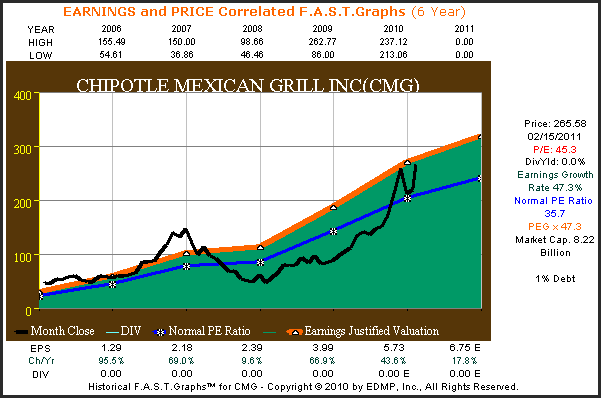

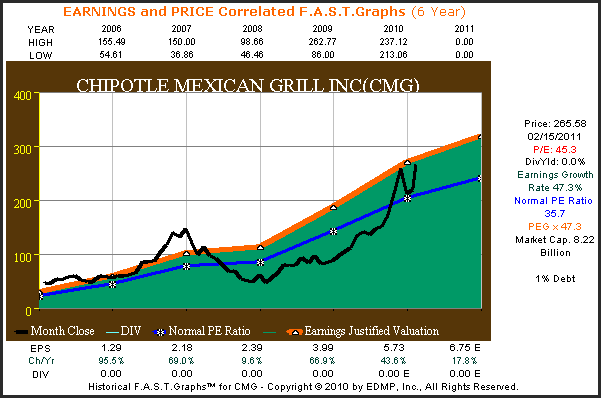

(Click to enlarge)The earnings and price correlated graph on Chipotle Mexican Grill provides an interesting perspective on valuation as it relates to high-growth stocks, in our opinion. From the graph below it is clear that the company’s stock price followed and even exceeded its earnings growth rate until earnings growth slowed to under 10% during the recession of 2008. However, it’s even more interesting to note how the stock price has steadily been climbing back to its previous high valuation as earnings growth once again resumed its normal trajectory.

(Click to enlarge)

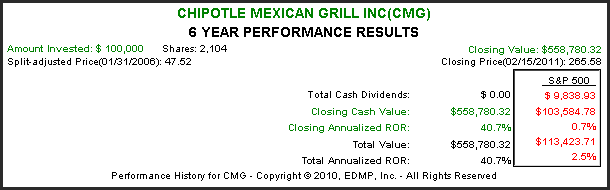

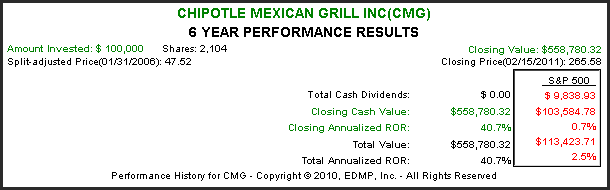

(Click to enlarge)Even though Chipotle Mexican Grill does not pay a dividend, shareholders have enjoyed capital appreciation in excess of 41% per annum since the company went public in early 2006. Even without a dividend of any kind, this company has proven to be an exceptional investment over the past five plus years.

(Click to enlarge)

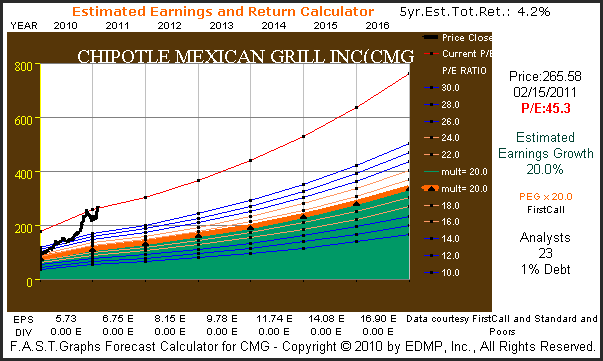

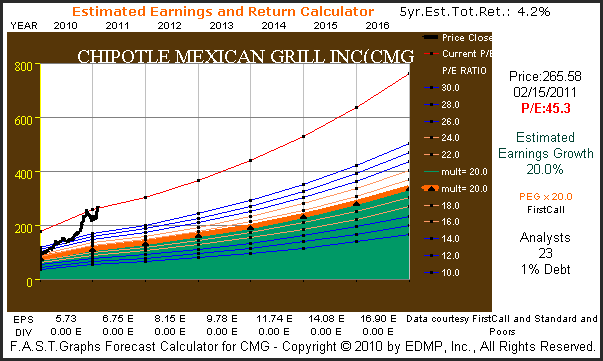

(Click to enlarge)The current consensus of 23 analysts reporting to FirstCall, expect Chipotle Mexican Grill to continue to grow at the above-average rate of 20% per annum. However, with their current PE ratio over 46, this would appear to be a very high valuation for this hot restaurant concept even if they achieve the consensus expected 20% rate of earnings growth.

(Click to enlarge)

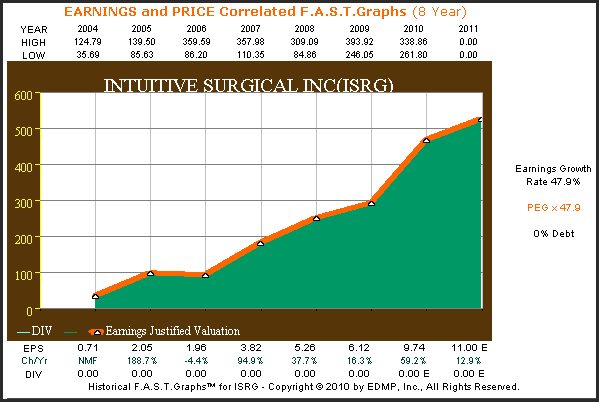

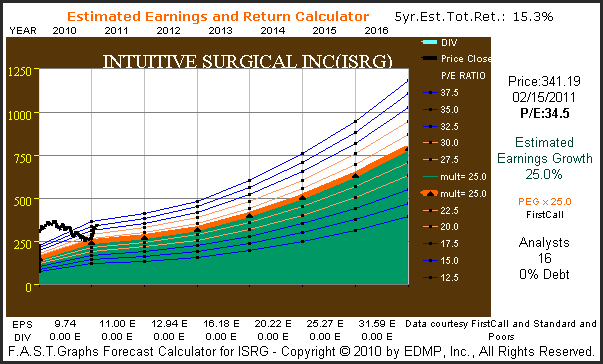

(Click to enlarge)Intuitive Surgical (

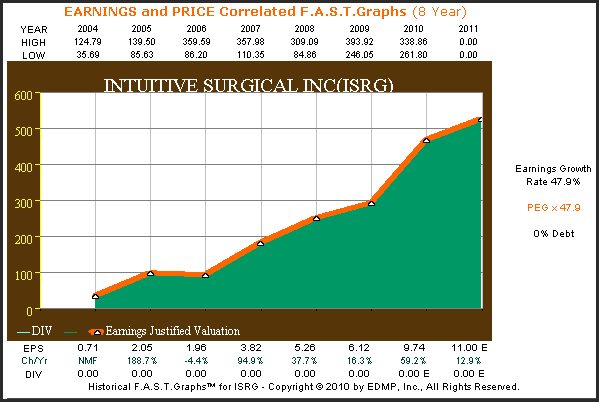

ISRG) designs and manufactures a robotic-type surgical system that translates surgeons’ movements on a consul while operating a laparoscopic surgical procedure inside the patient. This company has no debt on their balance sheet and has grown earnings in excess of 47% per annum. Once again our graph provides an instantaneous and comprehensive picture of the company’s historical operating history.

(Click to enlarge)

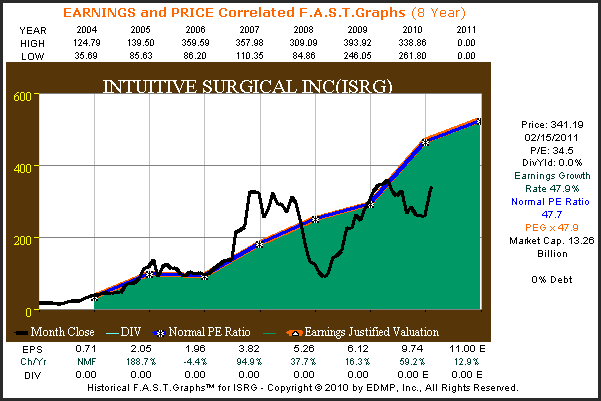

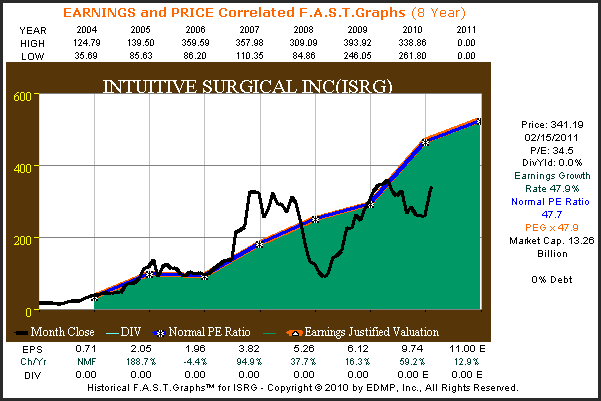

(Click to enlarge)With their exceptional rate of earnings growth, Intuitive Surgical has mathematically commanded a historical normal PE ratio that is virtually equal to its earnings-per-share growth rate. However, once again we see how statistics can be misleading. Although their normal PE ratio has approximated the earnings-per-share growth rate as a mathematical average, the volatility of their stock price has been extreme at times.

(Click to enlarge)

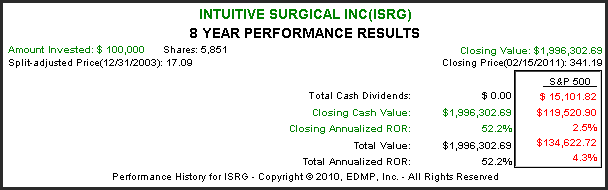

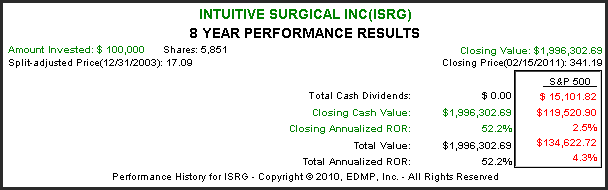

(Click to enlarge)Nevertheless, since calendar year 2004, long-term Intuitive Surgical shareholders have been lavishly rewarded for owning this high-growth company. The company pays no dividends, but thanks to earnings growth, capital appreciation from owning their shares has been exceptional. On the other hand, investors should take note of how volatile this stock has been at times.

(Click to enlarge)

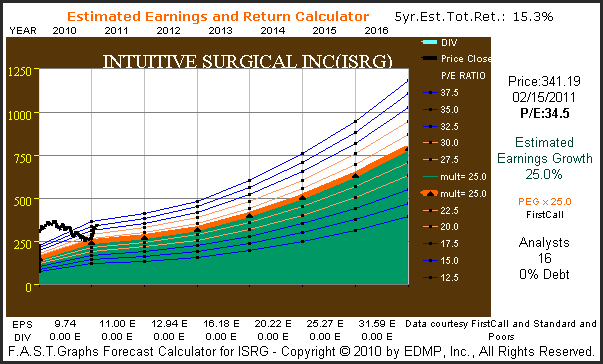

(Click to enlarge)The consensus of 16 analysts reporting to FirstCall, expect Intuitive Surgical to continue to grow earnings at 25% per year, or better, over the next five years. However, with the current PE ratio of just under 35 times earnings, it appears that their shares are overvalued for that expected growth rate. Nevertheless, the long-term return from here would still, more than likely be above average, but the risk of achieving it high.

(Click to enlarge)Historical earnings growth greater than 50% per annum:

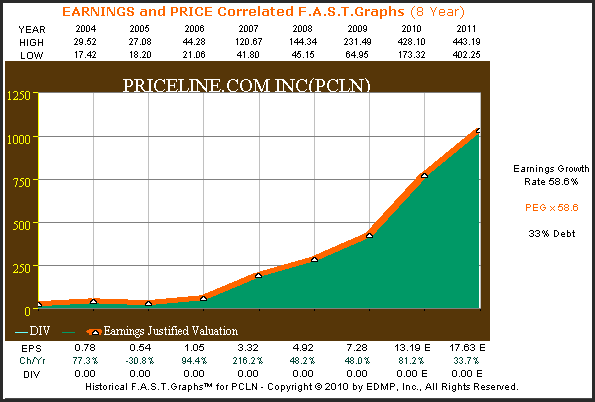

Priceline.com Inc. (PCLN) and Google Inc. (GOOG)

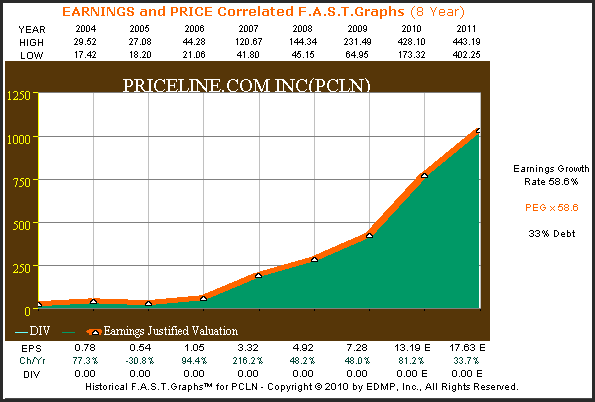

Priceline.com is an online travel agency best known for its “name your own price” service. Priceline.com went public in the spring of 1999 and suffered losses up through calendar year 2002. However, as we see from the F.A.S.T. Graphs below, the company’s earnings have been on a high trajectory since 2004.

(Click to enlarge)

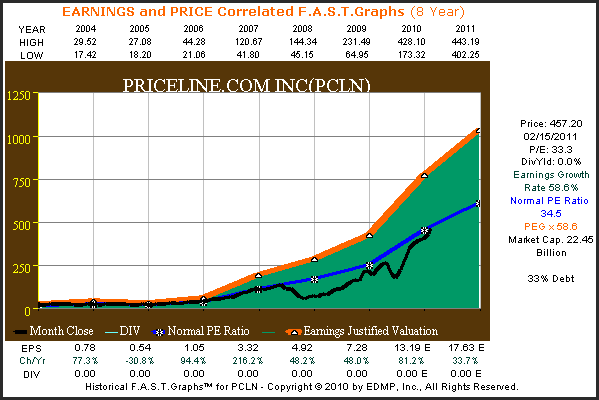

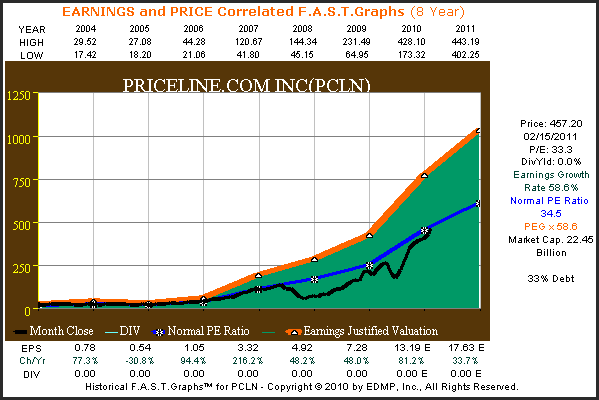

(Click to enlarge)As you can see from the earnings and price correlated graph below, Priceline.com has historically been awarded a normal price earnings ratio of 34.5. This is consistent with our thesis that once a price earnings ratio gets 30 or above the market finds it difficult to award a PEG ratio valuation.

(Click to enlarge)

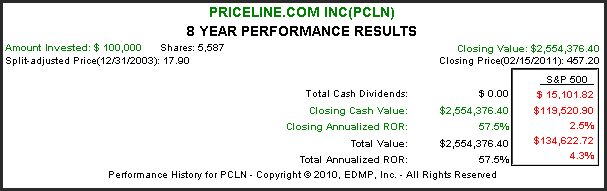

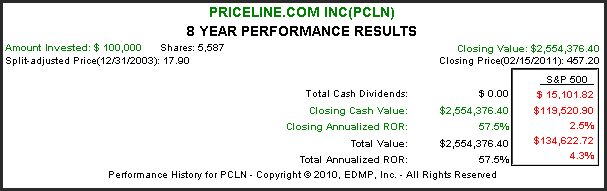

(Click to enlarge)What’s important from the calculated performance results for Priceline.com below is how closely they correlated to earnings growth. Even though their PE ratio of 34.5 was less than their 58.6% earnings growth, shareholder returns correlated very closely to earnings growth. This is because the market was consistently capitalizing their earnings which grew by over 50% per annum.

(Click to enlarge)

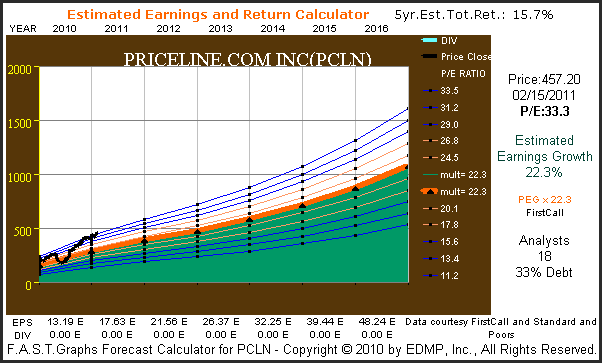

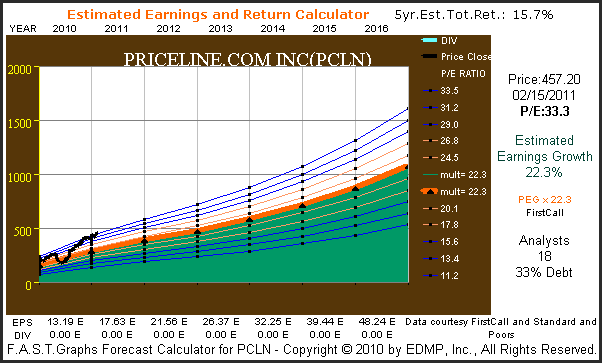

(Click to enlarge)The consensus of 18 analysts reporting to FirstCall, expect Priceline.com to grow future earnings at a rate of 22.3%. Since this is below their historical norm, and the 30% threshold mentioned above, it would be logical to assume that future valuation would revert to the PEG ratio formula. This is an important decision for the investor to make, because you can only buy the future, not the past. However, there is much that can be learned from the past.

(Click to enlarge)

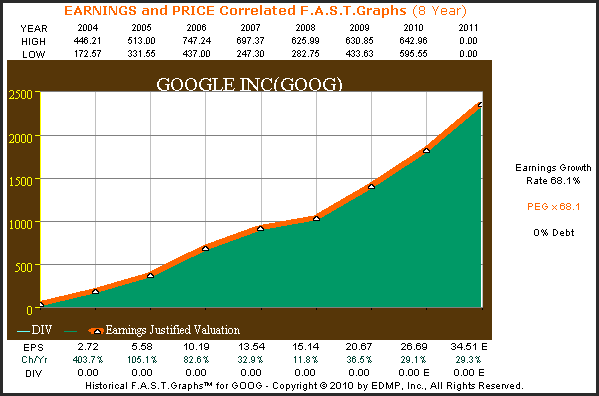

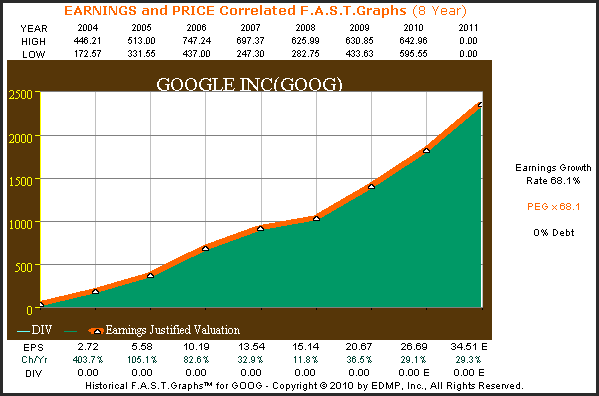

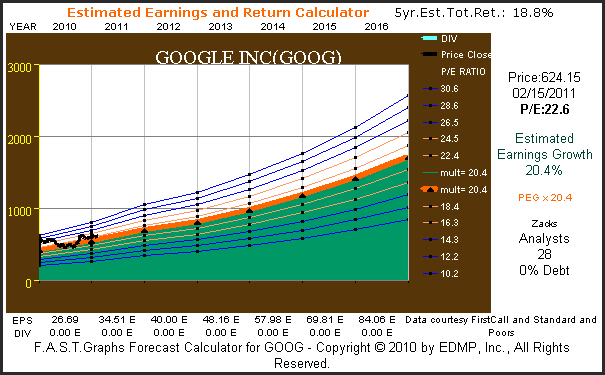

(Click to enlarge)Google Inc. hardly needs an introduction, and if you don’t know who the company is, you might try Googling it. This is one of the most widely recognized growth stories in modern history, and even perhaps of all time. From the graph below, it is readily apparent how powerful and consistent their growth has been since going public in August of 2004. Google has no debt on their balance sheet and has consistently been a cash-generating machine.

(Click to enlarge)

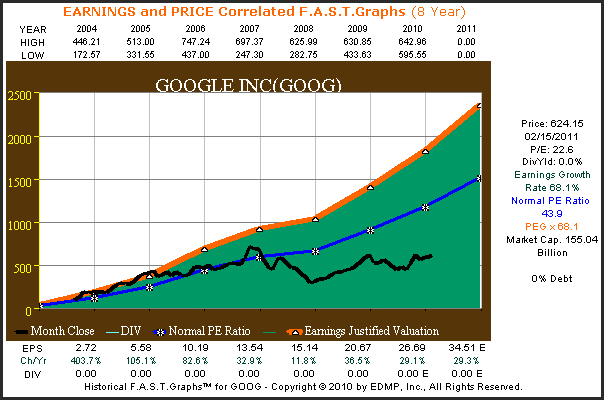

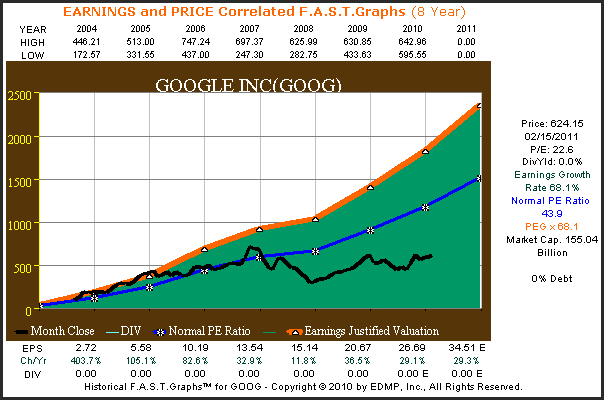

(Click to enlarge)After going public in August of 2004, Google’s stock price commanded a PE ratio of approximately 44 until the great recession of 2008. Since that time, their PE ratio has drifted into the 20s which has been consistent with their average growth rate since calendar year 2008. A quick glance at the bottom of the graph depicts the deceleration of earnings growth for this now over $150 billion market cap behemoth.

(Click to enlarge)

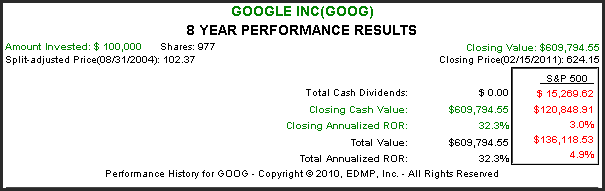

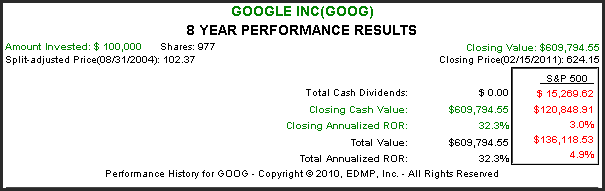

(Click to enlarge)As a result of Google’s earnings growth slowing as described above, shareholders received a rate of return, that although lower than their average growth rate of earnings since August of 2004, was nevertheless, extremely rewarding. The real lesson that these graphs illustrate, is how statistics alone can be misleading. Although Google did grow earnings at over 68% per year, their recent growth rate is clearly decelerating.

(Click to enlarge)

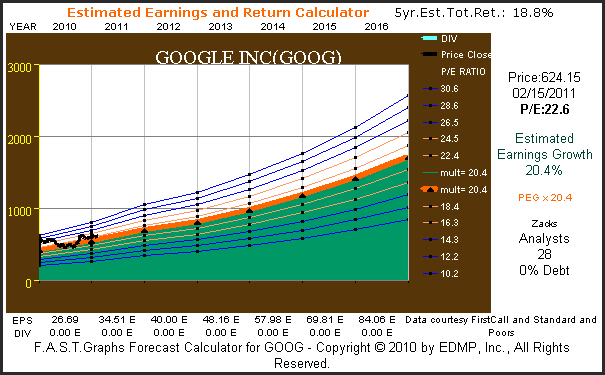

(Click to enlarge)Consistent with the discussion of Google experiencing decelerating earnings growth above, the consensus of 33 analysts reporting to FirstCall expect Google’s earnings to continue to grow at approximately 18% per annum. Therefore, at its current valuation of 22.6 times earnings, Google appears to be fairly valued to modestly overvalued at these levels.

(Click to enlarge)Apple Computer, the champion super growth stock

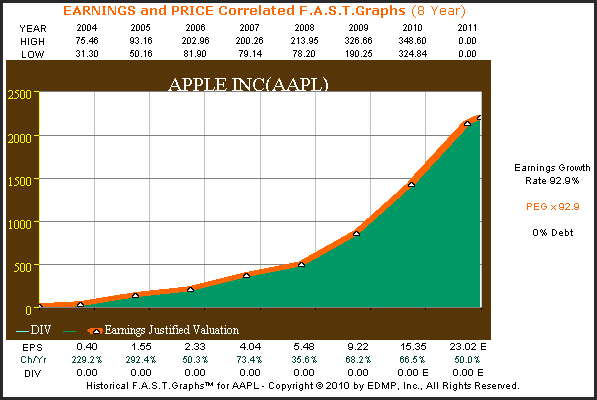

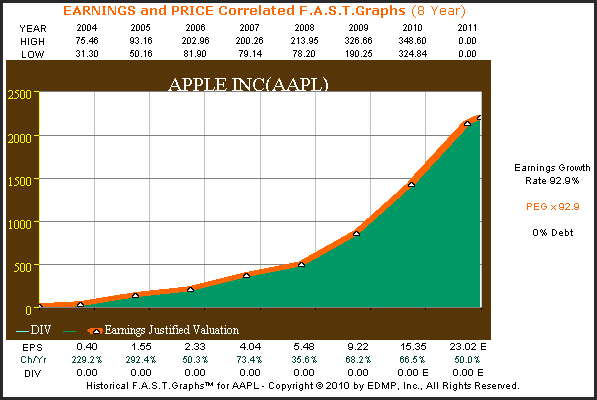

Our final example, and the champion super growth stock in this article, hardly needs an introduction. Not only is Apple (

APPL) the champion growth stock of our article, it’s one of the fastest-growing major tech stock on the planet as well. Thanks in large part to the i-Pod, iPhone and now the iPad, Apple Inc. has grown earnings at the astounding rate of 92.9% per annum since 2004.

(Click to enlarge)

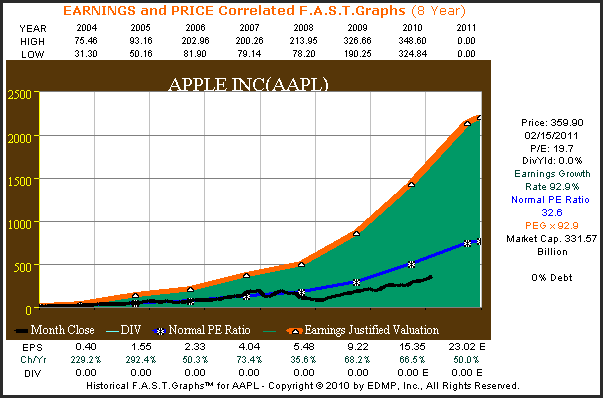

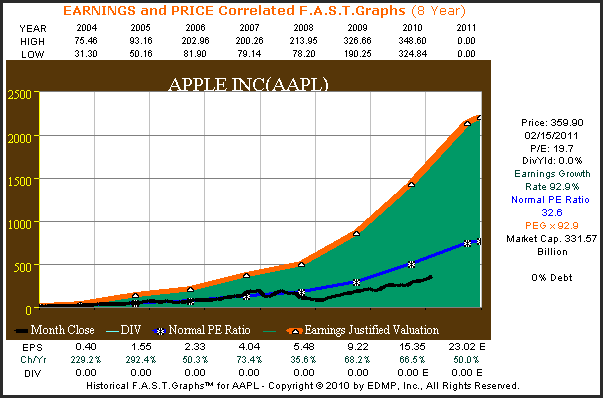

(Click to enlarge)When you consider Apple’s incredible record of growth, and great popularity, it is somewhat befuddling to see that it trades at a price earnings ratio below 20. Obviously, this torrid pace of earnings growth must, and is, slowing down to a mere 50% plus rate on average, since the great recession of 2008. Yet, you would think that a 50% growth rate might command a higher valuation for such a popular company, especially when you review the lofty valuations that the market is currently applying to many of the other names covered in this article. Oh the peculiar illogic of Wall Street, it will never cease to amaze us.

(Click to enlarge)

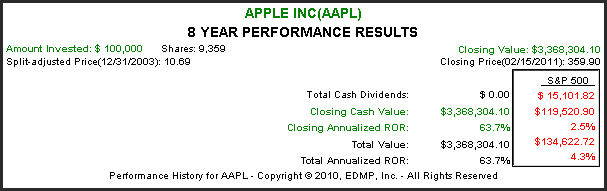

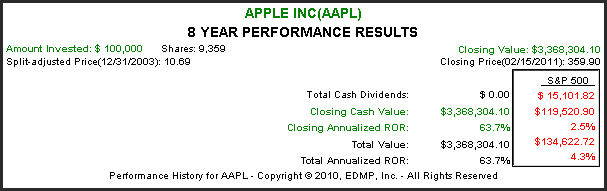

(Click to enlarge)Even with such a low relative valuation being applied to their shares, Apple stock has rewarded long-term shareholders lavishly since 2004. To us, it’s both interesting and ironic, that Apple Inc. possesses the following statistics: The company has the highest earnings growth rate of the nine companies covered, one of the lowest current price earnings ratios, and still has achieved the highest historical annualized performance.

(Click to enlarge)

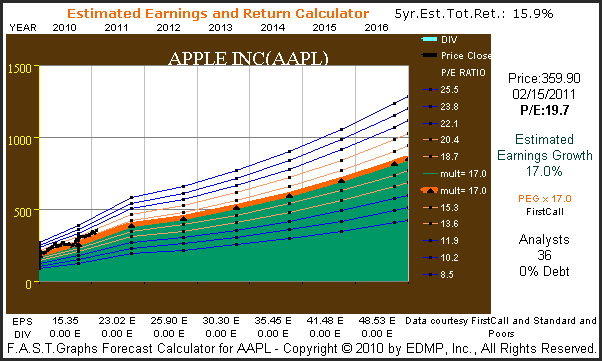

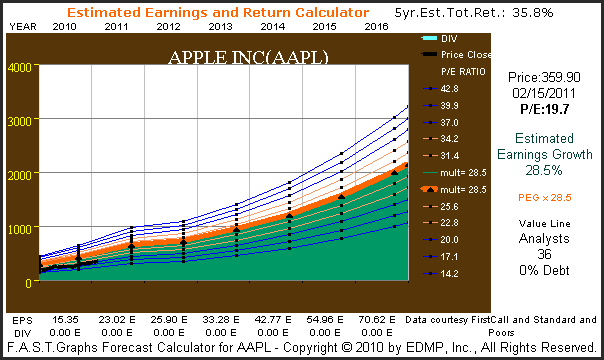

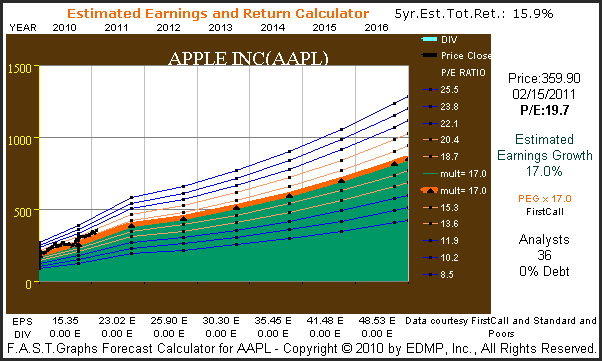

(Click to enlarge)The current consensus of 36 analysts reporting to FirstCall, forecast Apple to grow earnings at 17% per annum over the next five years. This is important when you consider that this is the lowest forecast earnings growth rate of the group of nine companies covered, applied to the company with the highest historical earnings growth rate. Nevertheless, assuming that this consensus earnings growth is correct, Apple stock would still represent an attractive stock at its current valuation.

(Click to enlarge)

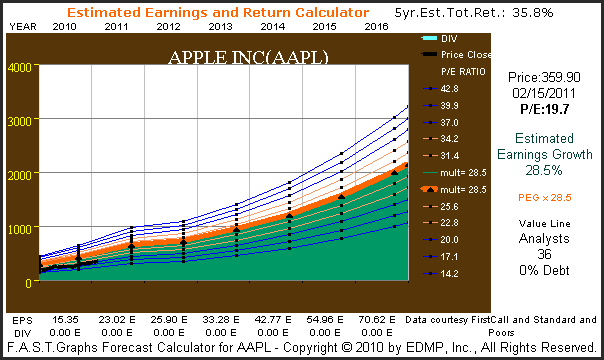

(Click to enlarge)As an aside, it’s interesting to mention that Value Line Investment Survey expects Apple to grow earnings in excess of 28% per annum out to the period 2015. If their number is correct, then Apple is extremely undervalued today. The estimated earnings and return calculator below depicts the future earnings growth for Apple Inc. based on Value Line’s estimate. Note that the estimated earnings and return calculator is simply that; a calculator. Users can input any number that they feel is relevant if they differ with consensus estimates as provided by FirstCall or Zacks.

(Click to enlarge)Conclusions

We hope that this primer on valuing super fast growing companies provided insights into how the market can capitalize such enormous growth. It may not always make sense, but we feel it’s valuable to be able to graphically see how the market values fundamentals. It’s not always logical, or even fair, but if you look hard enough there usually is some logic that can be discovered. The important thing is that statistics alone do not adequately tell the true whole story, in our opinion.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.