Introduction

One of the things that continuously frustrates us about the investment industry is how imprecise it can be with its definitions of important terms. A second frustration that follows muddy labels is the application of statistical analysis based on faulty or inaccurate descriptions of these important terms and concepts. In our opinion, ”value investing versus growth investing” is one of the most abused and misunderstood concepts that is prolifically written about and debated.

There’s a famous Warren Buffett quote where the “Oracle of Omaha” emphatically states that “growth and value investing are joined at the hip.” He goes on to explain that he would never invest in any company that he didn’t believe would grow, and that he would never be willing to pay more than it’s currently worth. It’s further alleged that based on this quote, the venerable investor, Peter Lynch, developed a hybrid strategy known as Growth At a Reasonable Price, or GARP.

The underlying thesis of this, our eighth article, in our series on how to value a stock, is based on the principle of True Worth™ valuation. Buying at sound valuation and “value investing”, as it is commonly referred to, are not the same thing. However, we will leave the concept of value investing for a different article. This article is concerned with growth stocks, and we intend to be very precise in how we define a growth stock. In fact, we will offer several definitions in order to clarify the concept of what a growth stock actually is.

If a company shows a history of consistently or regularly increasing earnings, then in the strictest sense, it can be called a growth stock. This would be true whether it grew at 1%, 5%, 10%, 15%, 20%, 30% or more. As long as earnings are growing, no matter what the rate, the company is a growth stock. Obviously, 1% or 2% growth rates are not what people normally imagine when they think of a growth stock. Most people would envision much faster rates of growth, but the fact is that growth is growth no matter how fast or slow.

Therefore, in order to add precision to the concept of what a growth stock is, we will break the category down into several sub definitions based on the company’s rate of earnings growth. The purpose of this exercise will be to illustrate how different growth stocks can be. Hopefully, this will illuminate the truth behind how unfair it is to lump them all into one broad basket. Not only is it true that all growth stocks are not the same, but the magnitude of the differences are truly profound. The power of compounding at higher growth rates produces extraordinary differences in shareholder returns.

Now, here is the most important part of clarifying the definition of a growth stock. The true definition of a growth stock has little or nothing to do with its stock price movement. Stock price movements are side effects of what true growth is really about. When we speak of growth stocks, we are talking about businesses that are capable of consistently increasing their earnings at the various rates we categorize them at in the paragraph below. A true growth stock, at all levels of growth, is defined as a company that generates shareholder value through consistent growth of their profits (earnings).

Growth Stocks Defined

We define companies growing earnings at rates of 5% per annum or less, as slow growth, or low growth stocks. Faster growing companies that grow their earnings from 5% to 15% per annum are defined as moderate growth stocks. Very fast growing companies that grow their earnings 15% to 25%, we will define as fast growers. Super-fast or hyper-growth stocks will be defined as any that can consistently grow at rates of 25% or better. This article will review 10 super-fast growth stocks, which are the most exciting and perhaps the truest category of a growth stock. In our next article, we will cover fast-growing companies (growing earnings 15% to 20% per annum).

The PEG Ratio (Price Equals Growth) Valuation Formula

The EDMP, Inc. F.A.S.T. Graphs™ were originally designed to value fast growing growth stocks and super fast growing growth stocks as defined above. Originally, our “fundamentals at a glance” research tool was programmed to calculate True Worth™ value based on the PEG ratio formula. Years of experience and research have supported the thesis that the Price Equals Growth rate (PEG) formula for calculating fair value accurately applies to companies that grow at 15% per annum, or better.

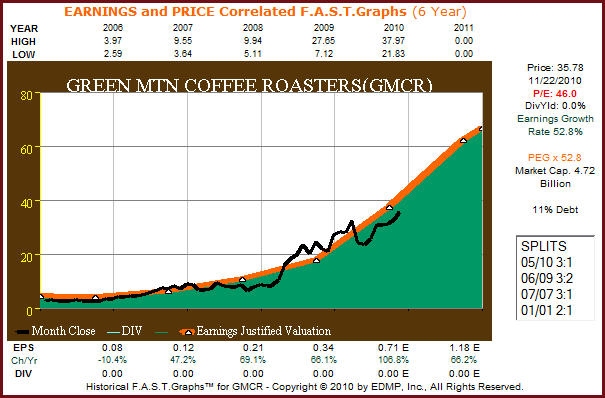

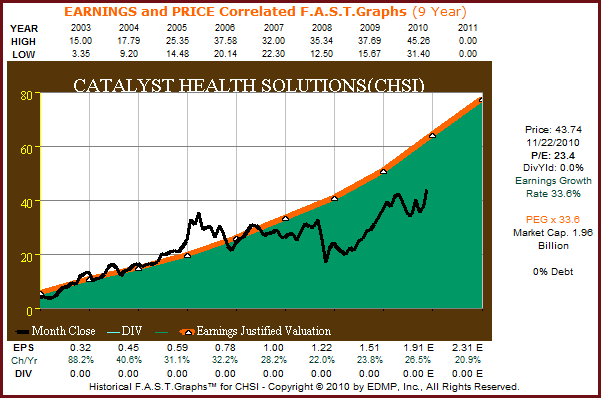

The slope of the orange line on each of the following EDMP, Inc. F.A.S.T. Graphs™ will be equal to its calculated earnings-per-share growth rate for whatever time frame the graph covers. This can be seen directly to the right of each graph. Note how closely the black monthly closing stock price line tracks earnings over long periods of time. Whenever price gets disconnected from earnings, over or under, it inevitably moves back into alignment. It’s only a matter of time.

The Value vs. Growth Debate

Before we look at specific examples of super-fast growth stocks, a few words about the value investing vs. growth investing debate are in order. There have been numerous studies published that suggest that value stocks have outperformed growth stocks over the long run. The following EDMP, Inc. F.A.S.T. Graphs™ are offered as clear evidence that this is a virtual impossibility.

We believe these graphs validate the undeniable truth, that there is no possibility that a value stock would ever outperform these pure unadulterated growth stocks. This further proves the old adage: “Statistics don’t lie, but statisticians do.” The truth boils down to how one defines a value stock versus a growth stock. Finding consensus on those definitions is virtually impossible. The following analysis will clearly illustrate how super-fast growth stocks will generate the highest total return of any category of stocks, as long as they are purchased at sound valuation.

10 Super-Fast Growth Stocks

A review of the following 10 super-fast growth stocks through the lens of our EDMP, Inc. F.A.S.T. Graphs™ will illustrate the power of earnings growth and their importance regarding generating long-term shareholder returns. This list is not all-inclusive, and contains both mid-cap and large-cap selections. Furthermore, we endeavored to provide a list that was broadly diversified over various sectors.

Also, note that for each company, we chose a time frame where it started out “in fair value” based on the PEG ratio formula. Most importantly, this is a historical review only, with no forecasting provided. Although we believe this analysis clearly validates the relationship between earnings and price for these super fast growers, future results may differ. Therefore, this is not a recommended buy list; instead it’s a list of super fast growth stocks that may be of interest for further research and analysis.

Green Mountain Coffee Roasters (GMCR): Six-Year Earnings and Price Correlated F.A.S.T. Graphs™

Green Mountain Coffee Roasters is a mid-cap specialty coffee and coffee maker supplier categorized in the packaged foods and meats sector. This super-fast grower has been prominently in the news recently due to the restatement of earnings based on accounting irregularities. Nevertheless, the accounting adjustments will be miniscule relative to their powerful earnings growth. The stock was up sharply on the announcement. The company has little debt on their balance sheet and has compounded earnings at over 50% per annum since calendar year 2006.

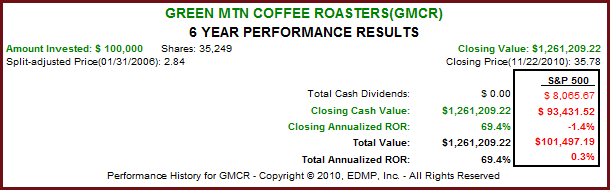

As seen with the performance graph below, extremely fast earnings growth has translated into extraordinarily high shareholder returns since calendar year 2006. Especially note how their share price and operating results were totally independent and, therefore, not correlated to the general economy or the stock market. Green Mountain Coffee Roasters (GMCR) shareholders might have asked: recession what recession?

Catalyst Health Solutions (CHSI): Nine-Year Earnings and Price Correlated F.A.S.T. Graphs™

Catalyst Health Solutions (CHSI), is a mid-cap full service pharmacy benefit management company classified under the Healthcare Services sector. As you can see, their earnings growth remained very strong through the recession of 2008, and though price faltered, the recovery has been swift and strong since the spring of 2009.

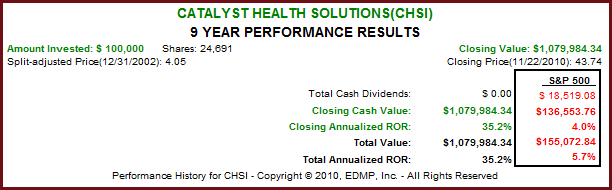

Since calendar year 2003 Catalyst Health Solutions (CHSI) has generated strong shareholder returns that closely mirror their rate of change of earnings growth. Once again, this super-fast growth stock has outperformed the S&P 500 by almost nine-fold, and their results are independent of the economy and the market.

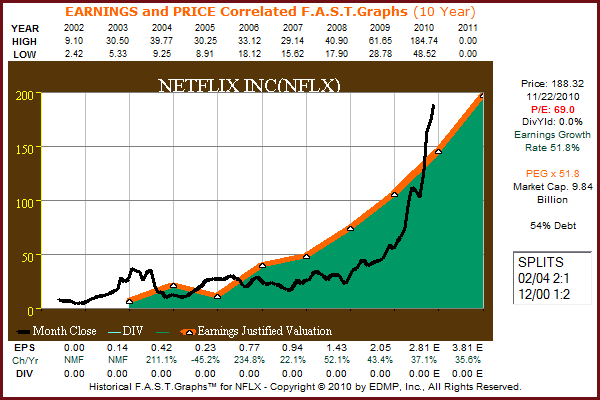

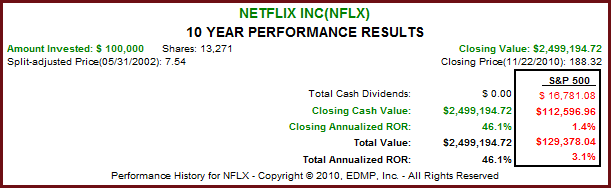

Netflix Inc. (NFLX): Ten-Year Earnings and Price Correlated F.A.S.T. Graphs™

Netflix is the leading Internet subscription service for movies and TV shows, and is a large-cap stock, classified in the Internet retail sector. As can be seen from the graph below, powerful earnings growth that exceeded 50% per annum, has led to an explosive rise in their stock price since calendar year 2008. Note, that on a historical basis, Netflix’s share price at over 63 times earnings is significantly higher than their earnings growth rate, indicating possible overvaluation.

Once again, thanks to super-fast earnings growth, Netflix shareholders were rewarded far in advance of the S&P 500 since they first went public in May of calendar year 2002. Only moderate overvaluation in 2002 kept their shareholder returns from equaling their earnings per share growth rate of over 51%.

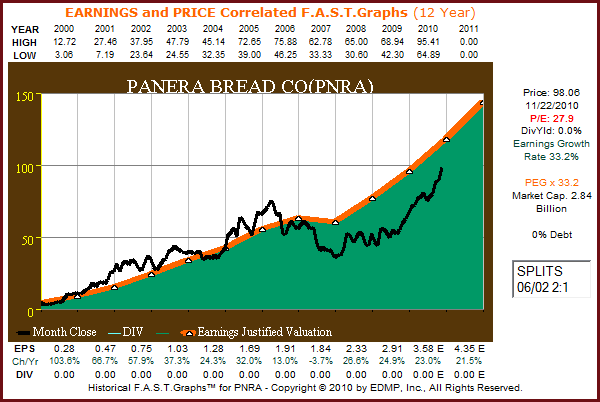

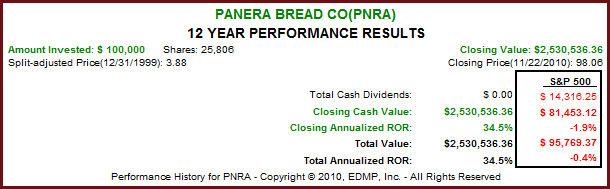

Panera Bread Company (PNRA): Twelve-Year Earnings and Price Correlated F.A.S.T. Graphs™

Panera Bread Company (PNRA) which owns and franchises retail bakery cafés in the United States, is a mid-cap stock, classified in the restaurant sector. The Panera Bread Company (PNRA), has consistently compounded earnings at over 33% since calendar year 2000, with only a slight hiccup in calendar year 2007. Notice that after the slight fall in earnings in 2007 their earnings growth has averaged only 23% per annum since. Therefore, even though their PE ratio of 27.7 is below their 12 year historical average earnings growth of over 33%, modest over valuation based on recent results may be manifest.

Once again we find that earnings growth and shareholder returns are closely correlated. Super fast earnings growth generated super strong shareholder returns during the time frame that has been known as the “lost decade” for the general stock market. Panera Bread Company (PNRA) is another example where general economic conditions and stock market results do not specifically apply.

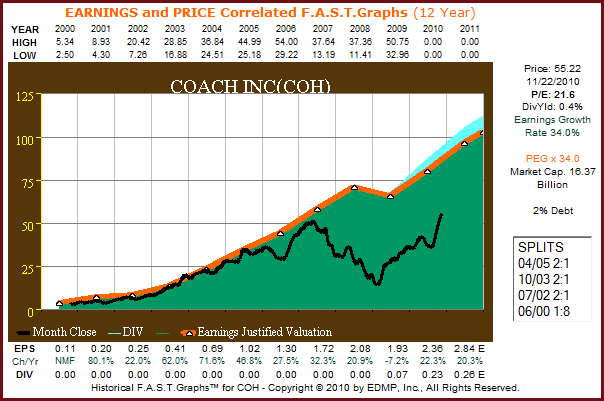

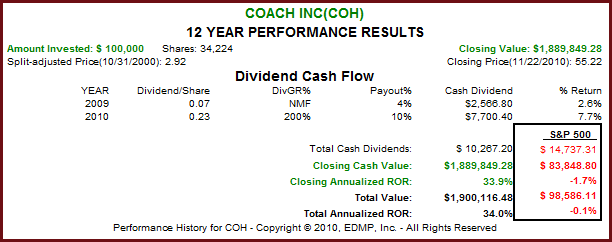

Coach Inc. (COH): Twelve-Year Earnings and Price Correlated F.A.S.T. Graphs™

Coach Inc. (COH) best known as a manufacture of mid-priced luxury handbags and accessories, is a large-cap stock classified in the apparel sector. The company has very little debt on their balance sheet and has initiated a dividend in calendar year 2009. This may be an indication that the company’s expectations for future growth is slowing down. However, their current PE ratio of just above 20 may be already reflective of that fact.

Eerily similar to the Panera Bread Company, the shareholders of Coach Inc. (COH) did not experience a “lost decade” since calendar year 2000. The total return for Coach Inc.’s shareholders over this time frame, were almost identical to the earnings growth rate the company achieved.

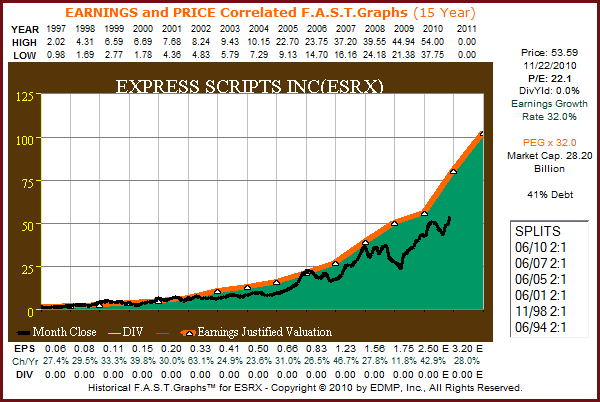

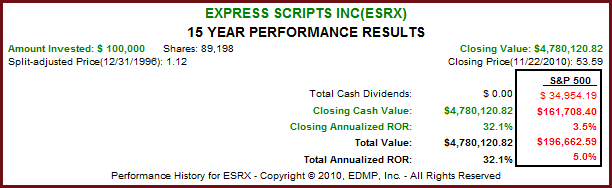

Express Scripts Inc. (ESRX): Fifteen-Year Earnings and Price Correlated F.A.S.T. Graphs™

Express Scripts is large-cap pharmacy benefit management company operating in North America and is classified in the Healthcare Services sector. As you can see from the graph below they have consistently generated earnings growth exceeding 30% per annum since calendar year 1997. As a company that is part of the healthcare solution, rather than the problem, the company has proven to be very recession resistant.

Once again, we find that super-fast growth stocks generate returns that closely correlate to their earnings growth. This is assuming of course, that the company is purchased at a sound valuation in the first place. Express Scripts, Inc. (ESRX) shareholders were rewarded by the company and not the stock market or the general economy.

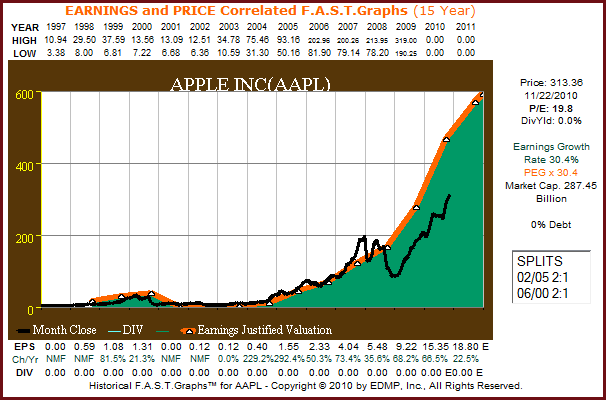

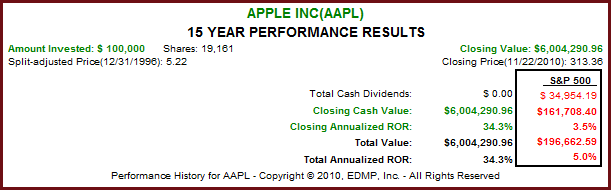

Apple Inc. (AAPL): Fifteen-Year Earnings and Price Correlated F.A.S.T. Graphs™

Apple hardly requires an introduction, as this large-cap manufacture of personal computers and mobile communication devices is well recognized. Apple Inc. is classified in the computer hardware sector, and it is only the second company on this list that would be considered a tech stock. The point being, that high-growth can be found across numerous sectors. Note that this period, 1997 to current, correspondence with the return of Steve Jobs to Apple. The historical and recent earnings growth this company is achieving is remarkable for a company in excess of $250 billion of market cap. This simply illustrates that is not necessary to be small in order to grow.

Since Apple’s iconic leader has returned to the helm, both earnings growth and shareholder returns have exceeded 30% per annum. During the time that Steve Jobs was absent, neither Apple’s earnings nor their stock price fared very well. This is a risk that everyone investing in Apple need be cognizant of.

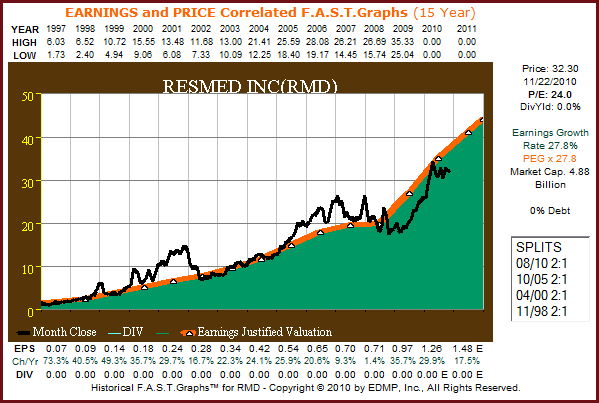

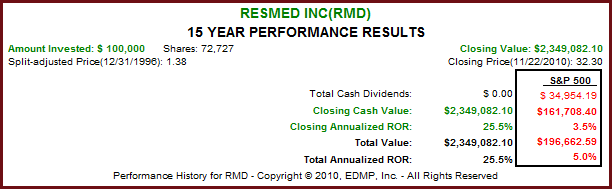

Resmed Inc. (RMD): Fifteen-Year Earnings and Price Correlated F.A.S.T. Graphs™

Resmed Inc. (RMD) is a manufacturer and developer of medical equipment for treating, diagnosing and managing sleep-disordered breathing issues. The company is a large mid-cap to small large-cap member of the healthcare equipment sector. The company is a quintessential example that exemplifies the validity of the price and earnings relationship. As you can see from the graph below, the company’s stock price has followed its earnings very closely. During the periods when the price became disconnected from the orange earnings justified valuation line, over or under, it inevitably returned.

Resmed’s earnings growth, of just under 28%, translates into shareholder returns of just above 25% per annum since 1997. Once again, shareholder returns were generated by the company’s operating excellence independent of the general market or economy.

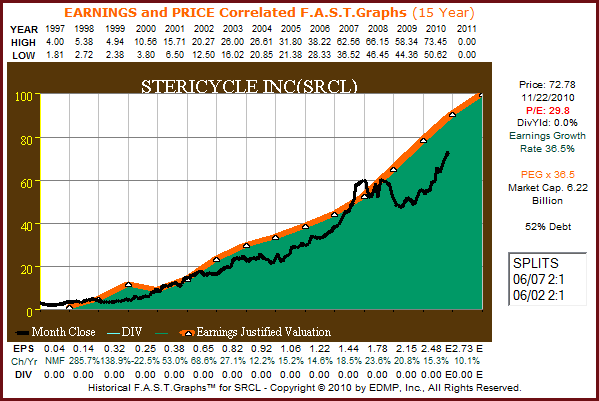

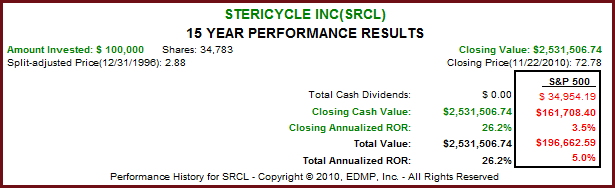

Stericycle Inc. (SRCL): Fifteen-Year Earnings and Price Correlated F.A.S.T. Graphs™

Stericycle Inc, is in the business of managing regulated waste. Their services include medical waste disposal and sharps disposal management, product recalls and retrievals, OSHA compliance training, pharmaceutical recalls and medical device returns, hazardous waste disposal, healthcare integrated waste stream management, pharmaceutical waste disposal, medical safety product sales, and high volume notification services. This large-cap company is classified in the environmental and facility services sector. As you can see from the graph below their business is lucrative, allowing them to produce consistently high growth. Although their debt is the highest of any company on this list, prodigious cash flow generation mitigates the risk.

Stericycle Inc. (SRCL) long-term buy-and-hold shareholders have been amply rewarded for their confidence. However, prospective investors should note that this company’s earnings growth rate has only averaged 17% per annum since calendar year 2003. Therefore, caution is warranted with the PE ratio close to 30 times earnings.

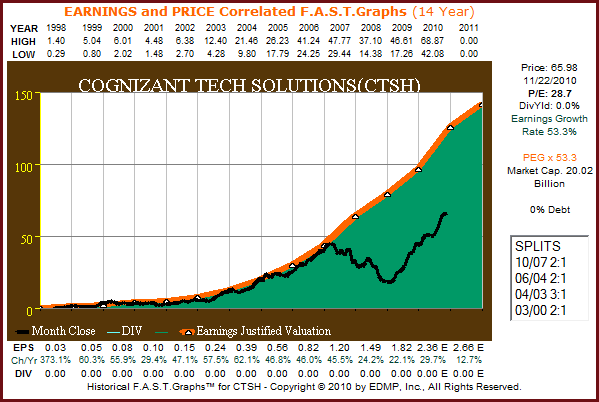

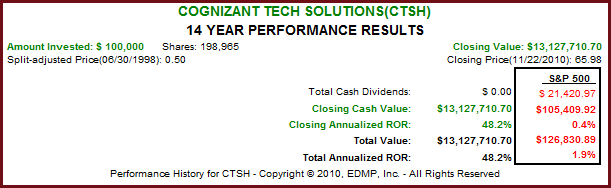

Cognizant Technology Solutions (CTSH): Fourteen-Year Earnings and Price Correlated F.A.S.T. Graphs™

Cognizant Technology Solutions (CTSH) is a major provider of outsourcing services, information technology consulting and other technology services to Global 2000 companies in North America, Europe and Asia. This high-quality large-cap company with no debt is classified in the IT consulting services sector. Of the 10 companies on the list, Cognizant Technology Solutions (CTSH), has generated the fastest earnings per share growth which has averaged in excess of 53% per annum. Because they provide a lot of services to the financial services sector, their stock price was hit especially hard during the great recession even though their earnings held up exceptionally well. Therefore, the stock price has swiftly recovered since the spring of 2009.

Cognizant Technology Solutions, our final example, shines a bright light on the importance of individual operating success to long-term shareholder returns. From the performance below, there should be no question in anybody’s mind, that Cognizant Technology shareholders were rewarded by the company’s specific earnings growth achieved, independent of the general stock market or the economy.

Summary and Conclusions

This review of 10 super-fast growth stocks, exemplifies the importance of understanding the undeniable relationship between earnings growth and market price over the long run. As previously stated, the list was not exhaustive, but hopefully illustrates the availability of many super-fast growth stocks across numerous sectors. Additionally, we are hopeful that this review also provided insights into how to intelligently value a growth stock to include the importance of valuation. Even for very fast growing companies like these, valuation matters. In fact, valuation is one of the keys to consistent investing results.

Interestingly, only one company on this list, Coach Inc. (COH), offers a dividend; however, you would be hard-pressed to find any dividend-paying company that has rewarded their shareholders as richly as this group has rewarded theirs. Even if you consider reinvesting dividends, there are no dividend-paying companies, that we’ve ever seen, that can compare to a super-fast growth stock purchased at a sound valuation.

This is not to say that we don’t like dividend paying stocks, because we very much do. However, that does not change the facts, that for shareholders seeking long-term capital appreciation, nothing quite compares to a super-fast growth stock. Of course, the risk of owning these types of companies is certainly higher than owning a blue-chip, dividend paying stalwart. Nevertheless, we believe that this class of super fast growing stocks should not be ignored.

This article is offered as a historical review of returns that can be achieved through owning extremely fast-growing companies, which we have dubbed as super-fast growth stocks. No buy or sell recommendation is implied on any of these names. Instead, we offer them as a compelling group of companies that would be worthy of future research and analysis. The key lies in forecasting future earnings as accurately as possible, and then assuring that valuations make sense based on those forecasts. We believe, you make your money on the buy side. Our next article will cover fast growing companies (15% to 20% earnings growth).

The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.