For any investor considering investing in cyclical stocks, the admonition from Kenny Rogers’ famous song “The Gambler” should be heeded: “You got to know when to hold ’em / Know when to fold ’em / Know when to walk away / And know when to run.“

As the recent great recession has so emphatically reminded us, investing can be a very treacherous endeavor. This is why we have always put such a premium on consistent, reliable and predictable earnings growth when screening for companies to invest in. Consequently, due to the erratic nature of their earnings performance, we have tended to eschew any company that we felt had a cyclical element to their business.

This is not to say that cyclical companies or stocks are never good investments. On the contrary, if you can figure out the right time to buy followed by the right time to sell, investing in cyclicals can be very rewarding. But like a thermos bottle that keeps hot things hot and cold things cold, the critical question is: How does it know? How to know precisely when to buy a cyclical stock is an extremely difficult question to answer.

This is our seventh article in our series on how to value stocks, and perhaps our most challenging. The very erratic and mostly unpredictable nature of cyclical companies and their operating performance goes hand-in-hand with making them extremely difficult to value correctly. However, just like all companies, the True Worth™ valuation of a cyclical stock is ultimately a function of its earnings and cash flows.

Yet the undeniable relationship between earnings and stock price is most vividly exposed when valuing cyclical stocks from the perspective of earnings to price. Therefore, cyclical stocks clearly validate the importance of earnings and cash flows to long-term investor returns. Unfortunately, the hard part with this class of equities is forecasting future earnings power with any degree of accuracy. The most important thing we can learn from studying the historical earnings patterns of cyclical stocks is that they are unpredictable.

There is one more important thing that needs to be said about cyclical stocks before we begin reviewing specific examples. One definition of cyclical stocks, according to Investopedia, is as follows: “A stock that rises quickly when economic growth is strong and falls rapidly when growth is slowing down.“Another definition might simply be a stock that produces spurts of earnings growth, followed by periods of falling earnings.

The point of this second definition is the lack of the mention of the general economy. In other words, some industries are, by their very nature, cyclical. Furthermore, a third, and even more simple, definition would be: Companies that have very erratic earnings growth.

Fundamental Valuations “At a Glance”

One of the best advantages of the F.A.S.T. Graph™ (fundamentals analyzer software tool) is its ability to provide essential fundamentals at a glance. In an instant, the user is provided a clear perspective of two critical elements. First, the reviewer can see how well a company has performed as an operating business over historical periods ranging from two to over 20 years. Second, the reviewer can see how stock prices have correlated to operating performance.

As previously stated, cyclical stocks demonstrate the earnings price relationship very clearly. Therefore, we will present several examples of companies whose operating results have been cyclical in nature based on one of the three definitions offered above. To make this premise as clear as possible, we will first produce a FAST Graph that plots earnings and dividends (if any) on each company.

Next, we will produce a second FAST Graph that overlays stock price on top of earnings and dividends (if any). Finally, we will produce a performance chart that calculates the returns associated with the price- and earnings-correlated graphs.

The S&P 500: A Proxy for the General Economy

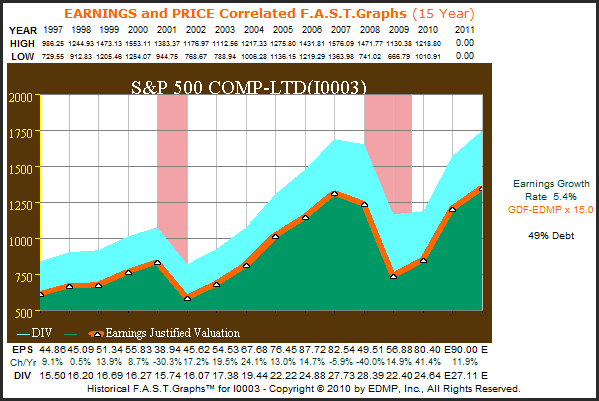

In order to establish a benchmark, our first graph looks at the S&P 500 operating earnings and dividends plotted since 1997.The recessions of 2001 and the great recession of 2008 are shaded in red, indicating these periods of general economic weakness.

We will not overlay stock prices on this graph, as it is only offered to provide a perspective of economic growth and/or weakness. Although there are growth stocks within this index of 500 companies, the general cyclical nature of the composite reflects the state of the economy generally.

S&P 500 15yr. Earnings Only F.A.S.T. Graph™

United States Steel Corp. (X)

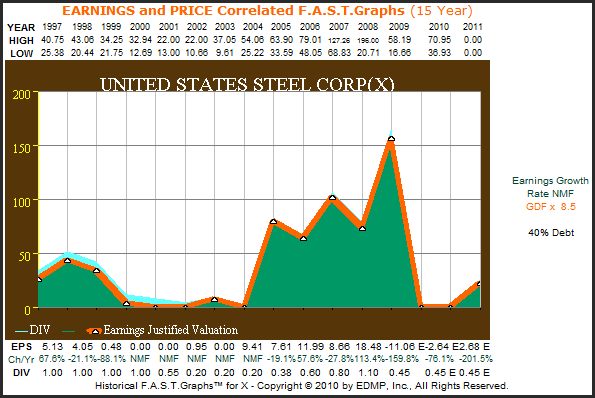

United States Steel Corporation (X) is one of the world’s largest integrated steel producers. The steel industry is considered a cyclical industry, and United States Steel Corporation is a member of the Morgan Stanley cyclical stock index (CYC.X).

As you can see from the graph below, United States Steel Corporation has a very erratic history of earnings growth that reasonably correlates to the general economy as represented by the S&P 500 graph above. From 1998, earnings of $5.13 fell precipitously to virtually nothing until rising sharply to $9.41 in 2004. Then we see a roller coaster ride of earnings performance culminating in significant losses in 2009.

X 15yr. Earnings Only F.A.S.T. Graph™

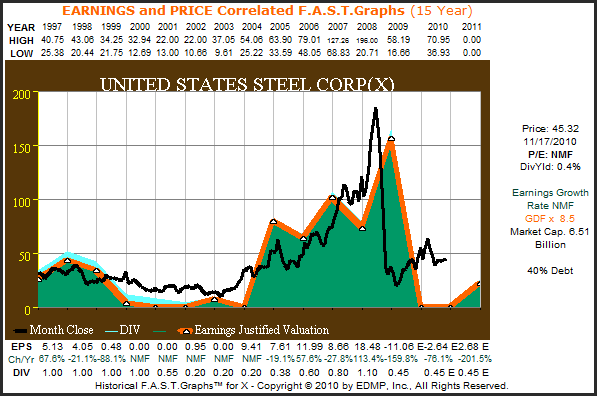

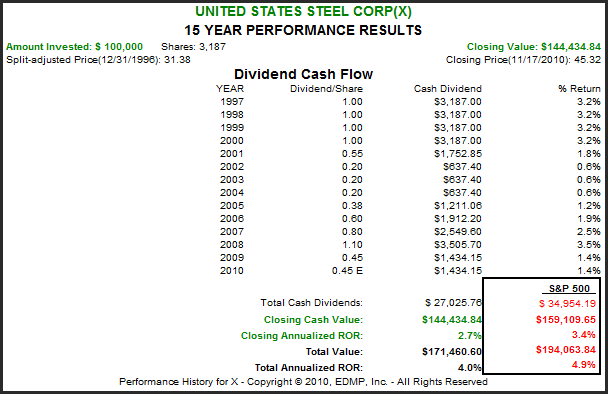

In the price- and earnings-correlated graph below, we overlay monthly closing stock prices onto the graph, and the relationship between earnings and stock price is very profound.First, stock prices generally drifted lower as earnings drifted lower, then rose significantly with earnings until falling precipitously as earnings fell in 2009.

Note that stock prices in this example began their descent in 2008, apparently in anticipation of earnings collapsing. From the performance graph we see that shareholder returns and dividends were not only erratic, but trailed the S&P 500.

X 15yr. Earnings & Price Correlated F.A.S.T. Graph™

X 15yr. Performance Results

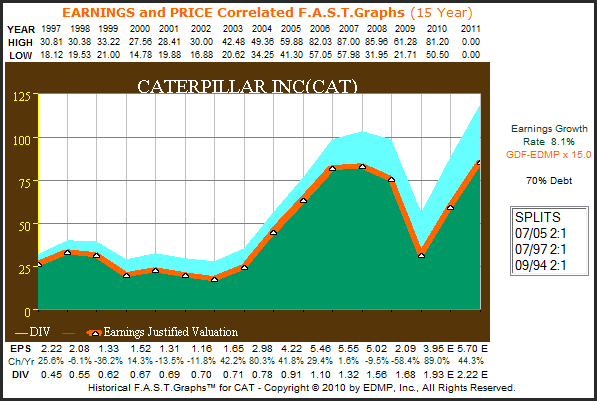

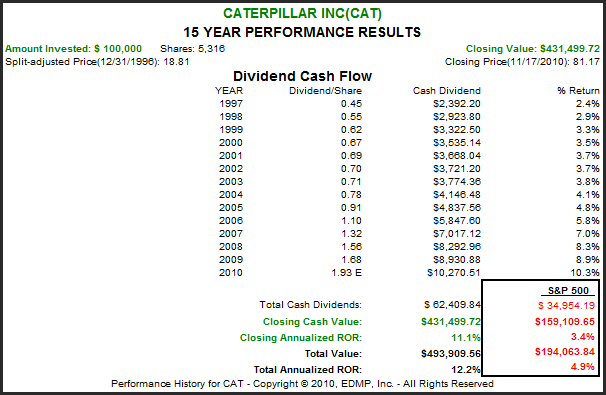

Caterpillar Inc. (CAT)

Caterpillar Inc. (CAT) is the world’s largest producer of earth moving-equipment. As a member of the machinery industry, Caterpillar provides a second example of a recognized cyclical stock. Caterpillar is also a member of the Morgan Stanley cyclical stock index.

Even though the erratic rise and fall of Caterpillar’s earnings are not as extreme as United States Steel Corporation, nevertheless its earnings results closely correlate to the S&P 500’s earnings results — however, at a faster 8.1% growth rate. Caterpillar fits the “Investopedia” definition of a cyclical stock.

CAT 15yr. Earnings Only F.A.S.T. Graph™

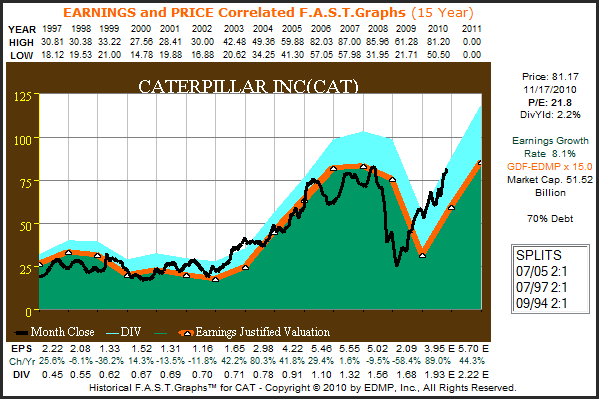

When you overlay monthly closing stock prices to its operating history, as we do below, the price and earnings relationship is profoundly correlated.Although the expected short-term up and down movements of Caterpillar’s stock price are clearly evident, the longer-term trend of its stock prices clearly track earnings.

From the performance graph associated with the price- and earnings-correlated graphs, it’s clear that long-term returns of both dividend income and capital appreciation are a direct function of earnings adjusted by modest overvaluation currently.

CAT 15yr. Earnings & Price Correlated F.A.S.T. Graph™

CAT 15yr. Performance Results

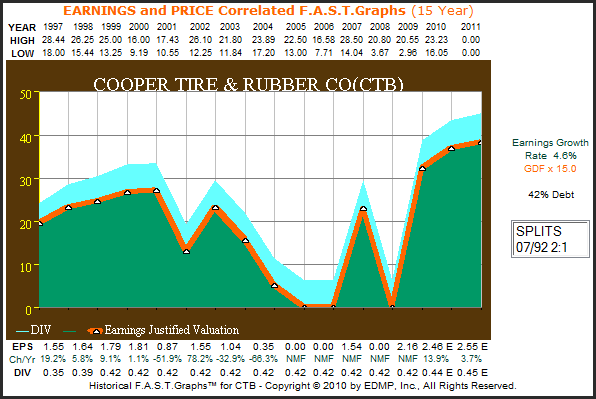

Cooper Tire (CTB)

Cooper Tire (CTB) is one of the largest tire makers in the world and the fourth largest in North America.The auto parts industry, of which Cooper Tire is a member, is very cyclical in its own right and often independent of general economic activity.

The cyclical nature of Cooper Tire becomes instantly visible by reviewing its operating results since 1997. The fact that the earnings performance is often contra to general economic activity makes forecasting future earnings for Cooper Tire extremely difficult.

CTB 15yr. Earnings Only F.A.S.T. Graph™

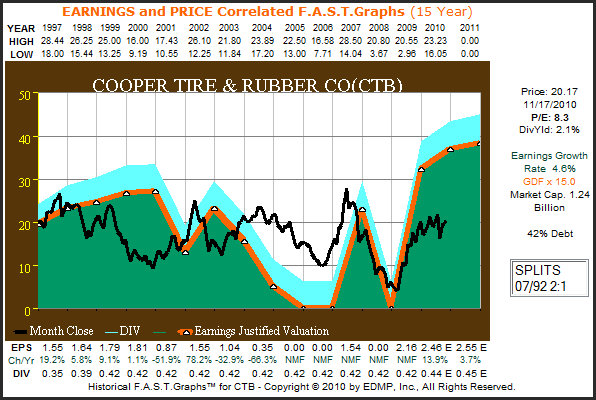

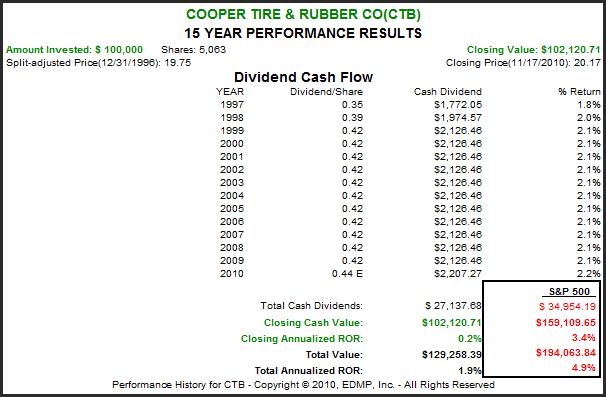

Once again we find that stock prices track earnings very consistently. However, as we just pointed out, it would be very difficult to forecast where earnings may go next. Interestingly, though, in the performance chart below we find that Cooper Tire’s dividend rate has been consistently maintained through it all, but did not increase. Nevertheless, its consistent dividend record did not save long-term shareholders from underperforming the S&P 500.

CTB 15yr. Earnings & Price Correlated F.A.S.T. Graph™

CTB 15yr. Performance Results

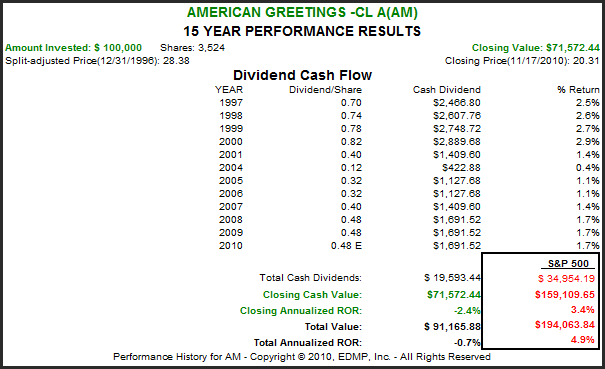

American Greetings (AM)

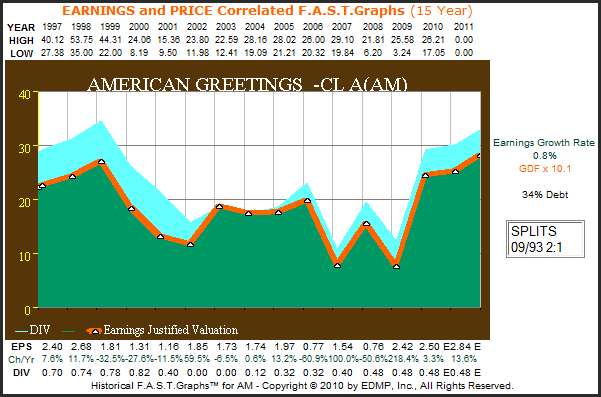

The publishing industry is another that is known for its cyclicality. American Greetings Corp. (AM) is the second-largest producer of greeting cards in the United States. As you can see from the graph below, American Greetings has produced extremely unpredictable and erratic earnings growth since 1997.

AM 15yr. Earnings Only F.A.S.T. Graph™

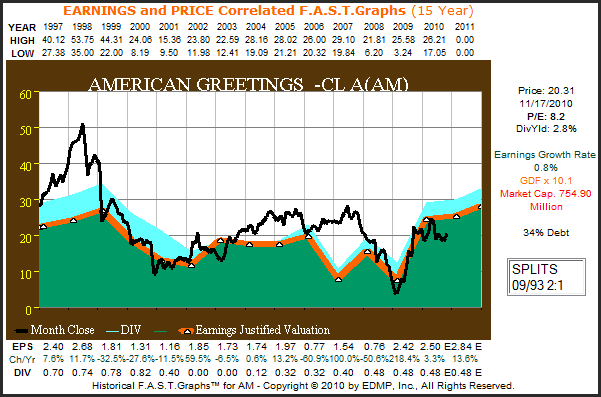

Once again, by overlaying monthly closing stock prices to the earnings graph we see a very strong relationship between the two.An interesting aside that we see on this particular company is how overvalued stock prices had become in 1997 and 1998, before three years of falling earnings brought it all to a very dramatic end.

Also, from 2001 through today, essentially neither stock prices nor earnings have gone anywhere. Therefore, it is no surprise to find that shareholders of American Greetings would have suffered losses since 1997.

AM 15yr. Earnings & Price Correlated F.A.S.T. Graph™

AM 15yr. Performance Results

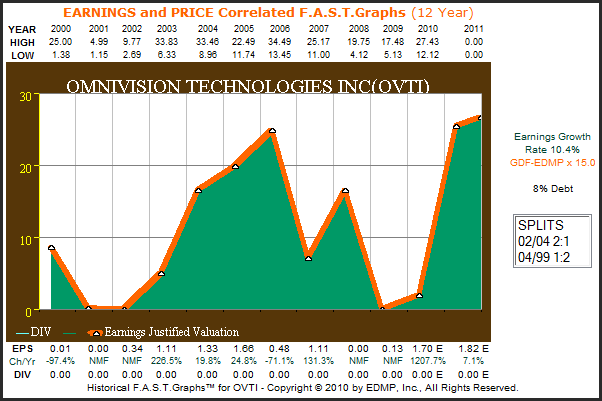

Omnivision Technologies, Inc. (OVTI)

Omnivision Technologies, Inc. (OVTI) is a leading supplier of imaging chips based on complementary metal oxide semi-conductor [CMOS] technology. Its camera chips provide all imaging functions integrated into a single chip, which makes them ideal for the cellular phone and surveillance markets.

The recent rapid growth in the Smartphone industry has been a major contributor to the spectacular earnings growth estimates for fiscal 2010. However, as can be seen from the plotting of its earnings since the company went public in July of 2000, its operating results have been very cyclical and unpredictable.

OVTI 12yr. Earnings Only F.A.S.T. Graph™

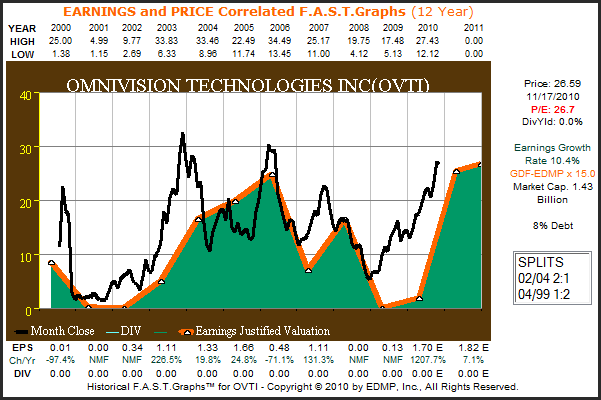

When stock prices are overlaid on top of the earnings chart, the relationship between price and earnings is quite clear. However, due to hype that can often be associated with high-tech advancements, occasional bouts of significant overvaluation, followed by plunging stock prices, are more the norm than the exception.

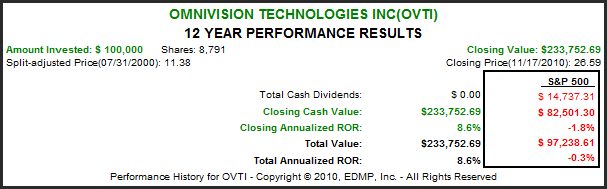

On the other hand, if you can navigate the volatility and cyclicality of its earnings, powerful short-term returns can be had. The spring of 2009, when the stock price and earnings both were very weak, would have been an attractive time to take a position in this volatile tech stock. Although its long-term performance has been attractive relative to the S&P 500, it clearly did not come without volatility risk.

OVTI 12yr. Earnings & Price Correlated F.A.S.T. Graph™

OVTI 12yr. Performance Results

Timberland Company (TBL)

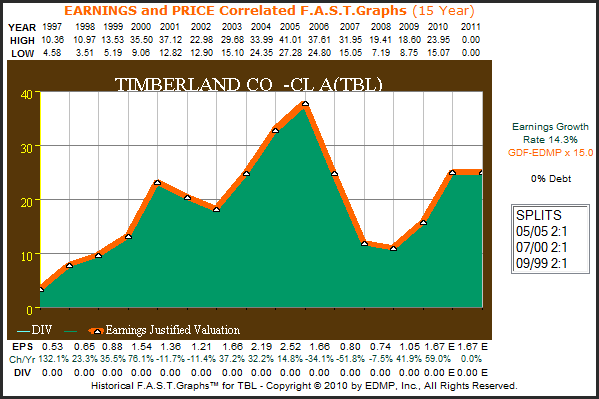

Timberland (TBL) is a leading developer of footwear, apparel and accessory products for the whole family. Once thought of as a growth stock, the cyclical nature of its business has become readily apparent since calendar year 2005. Even though its earnings growth has been over 14%, the path to achieving those results has been both lumpy and treacherous at times.

TBL 15yr. Earnings Only F.A.S.T. Graph™

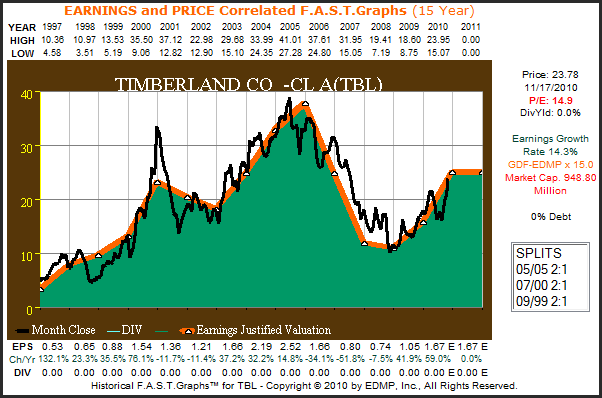

When you overlay stock prices with earnings per share, the functional relationship and correlation of price-to-earnings is crystal clear. In the long run, where earnings went, stock prices were sure to follow. Even though there were the occasional bouts of price becoming disconnected from earnings over the short run, inevitably price tracked earnings.

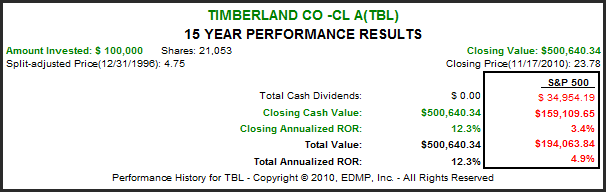

At the end of the day, long-term buy-and-hold shareholder returns correlated very closely with Timberland’s operating performance. However, what needs to be considered by investors is whether or not they would have had the fortitude to hold through all the volatility of both price and earnings.

TBL 15yr. Earnings & Price Correlated F.A.S.T. Graph™

TBL 15yr. Performance Results

Summary

One of the major points that we hope this review of cyclical stocks makes is how erroneous it is to stereotype stocks or markets. The idea that a cyclical stock is one whose earnings rise and fall in conjunction with the general economy does not hold water. Therefore, if this was your general understanding of what a cyclical stock is, you could easily be misled.

Caterpillar, and perhaps even US Steel, might have fit the definition of economic sensitivity fairly well, while Cooper Tire and American Greetings represent examples of companies with very industry-specific drivers of their operating results, often independent of economic activity. This is why we always stress building your portfolio one company at a time. In the short run, economic activity will have its impact, but in the longer run it’s the specific performance of the business that matters most.

Conclusions

Perhaps the primary conclusion that can be drawn from this analysis would be that cyclical stocks do not warrant a traditional buy-and-hold investing approach. Stock price movements, along with earnings movements of cyclical stocks, can be very erratic and span several years in duration. Consequently, a degree of nimbleness is required when investing in companies with these kinds of operating characteristics. Even dividends cannot be reliably counted on when investing in cyclicals.

With the above said, this analysis also reveals the strong correlation and functional relationship between earnings and stock prices and, ultimately, shareholder returns. Understanding these relationships is a critical task that we believe all investors should master. As cyclical stocks illustrate, the task is not always easy nor is it always straightforward, but it is critical to long-term success. A thorough and comprehensive research effort is unavoidably required.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.