Headquartered in Issaquah, Washington, Costco (COST) reported fiscal year fourth quarter earnings Wednesday that beat street estimates only to see its shares slide. Although earnings were two cents better than estimated, revenues came in a little short. So far, the media is attributing Wednesday’s stock slide to the revenue miss and slightly slower September sales growth.

All in all, we feel that Costco turned in a good quarter and a strong recovery over calendar year 2009. Net earnings were up approximately 16% for the fiscal quarter and at $2.92 for the year, up 14.5% over 2009 earnings of $2.57. Therefore, on the surface everything looks fine. However, a deeper look at Costco’s lofty valuation is of concern, in our opinion.

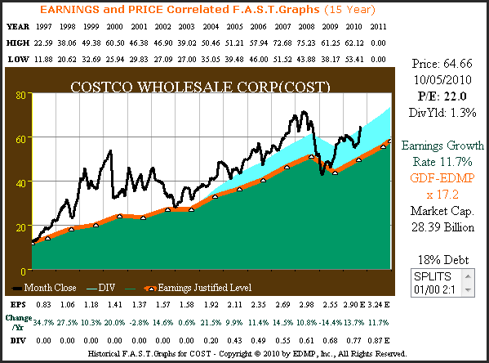

Figure 1 below looks at Costco through the lens of our EDMP F.A.S.T. Graphs™ since 1997. Costco has grown earnings per share by 11.7% and offers a dividend yield of 1.3%. The black price line is currently above the earnings justified valuation line with a calculated fair value PE of 17.2. Therefore, we contend that Costco is overvalued with a PE ratio of 21.9.

Figure 1 COST 15yr. Growth Correlated to Price (Click to enlarge)

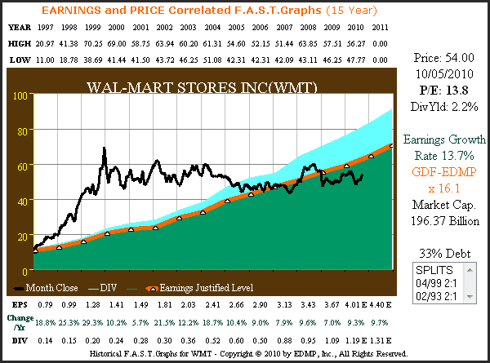

Figure 2 below looks at Wal-Mart (WMT) whose Sam’s Clubs stores are a major competitor of Costco. Wal-Mart has grown earnings faster and more consistently than Costco, yet only trades at a PE ratio of 13.8 versus Costco’s PE of 21.9. Wal-Mart pays a higher dividend yield than Costco, but does have a little more debt. Nevertheless, it seems odd that Wal-Mart shares currently trade at such a discount to Costco.

Figure 2 Wal-Mart 15yr. Growth Correlated to Price (Click to enlarge)

Conclusion

Costco certainly had a decent quarter and its long-term record of earnings growth is also very solid. However, Wal-Mart has done better on all counts. Yet it sells at a much lower valuation and even offers a higher dividend yield. Therefore, it would be hard for us to buy Costco today when Wal-Mart is available at more than a third off.

We believe that you make your money on the buy side, and getting valuation correct is critical. Earnings growth is important because that’s what will generate the future stream of income that investors will be rewarded by. However, if you overpay, then good operating results can be for naught.

Disclosure: No position at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.